If you’ve ever wondered whether Your Monthly Rent Payment Is an Example of a Variable Expense., you’re not alone. This common misconception trips up many people when budgeting.

The answer is definitively FALSE—rent is a fixed expense, not a variable one. Understanding this distinction is crucial for effective financial planning and money management.

Let’s clear up the confusion and explore why proper expense categorization matters for your budget.

Table of Contents

The Answer: Is Your Monthly Rent Payment Is an Example of a Variable Expense.?

No, your monthly rent payment is NOT a variable expense—it’s a fixed expense. This is one of the most misunderstood concepts in budgeting, but the reasoning is straightforward.

Rent qualifies as a fixed expense because it remains consistent and predictable month after month. When you sign a lease agreement, you commit to paying the same amount for a specific period, typically 6-12 months. Whether you use your apartment extensively or barely stay home, your rent payment doesn’t change.

For example, if your monthly rent is $1,500, you’ll pay exactly $1,500 in January, February, March, and every subsequent month until your lease term ends. This predictability is the hallmark of fixed expenses and makes rent fundamentally different from fluctuating expenses like groceries or utilities.

The confusion often arises because people conflate “housing costs” generally with rent specifically. While some housing-related expenses like electricity bills vary monthly, the rent payment itself is a contractual obligation with a predetermined amount—making it one of the clearest examples of fixed expenses in personal finance.

Understanding Fixed Expenses

What Are Fixed Expenses?

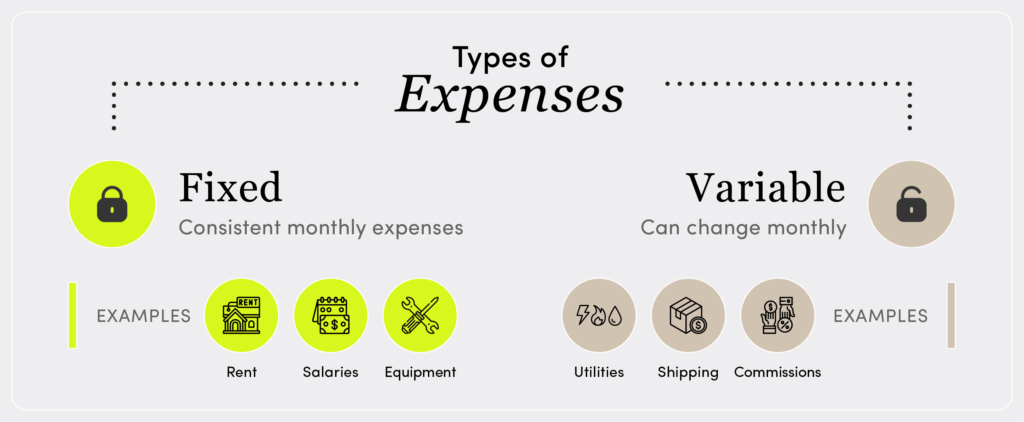

Fixed expenses are predictable costs that remain constant over time, typically recurring on a regular schedule. These are essential expenses you can count on paying the same amount each billing cycle, making them easier to plan for in your budget.

Key characteristics of fixed expenses include:

- Consistency: The amount stays the same each period

- Predictability: You know exactly how much you’ll pay in advance

- Recurring nature: They happen regularly (monthly, quarterly, or annually)

- Contractual obligations: Often backed by agreements or contracts

- Limited flexibility: Difficult to reduce or eliminate in the short term

Common Examples of Fixed Expenses

| Expense Type | Why It’s Fixed | Typical Amount |

|---|---|---|

| Rent or mortgage payments | Lease/loan agreement sets fixed amount | Varies by location |

| Car payments | Auto loan with set monthly installment | $200-$700/month |

| Insurance premiums (auto, health, life) | Annual or semi-annual rates | $100-$500/month |

| Subscription services | Netflix, Spotify, gym memberships | $10-$100/month |

| Loan payments | Student loans, personal loans | Varies by debt |

| Internet and phone bills | Monthly service plans | $50-$150/month |

Why Rent Is a Perfect Example of a Fixed Expense

Your monthly rent payment exemplifies fixed expenses for several compelling reasons:

- Lease agreement guarantees: When you sign a rental contract, you legally commit to paying a specified amount for the lease duration. Your landlord cannot arbitrarily increase this amount mid-lease, and you cannot decide to pay less because you’re on vacation.

- Predictability for budgeting: Since you know your exact rent obligation months in advance, you can allocate this portion of your income with complete certainty. This predictability is invaluable for budget planning and ensures you prioritize this essential expense.

- Contractual obligations: Your rent represents a binding agreement. Unlike variable expenses where you control spending amounts, your rent payment is non-negotiable during your lease term. This contractual nature firmly establishes rent as a recurring cost with zero monthly fluctuation.

Understanding Variable Expenses

What Are Variable Expenses?

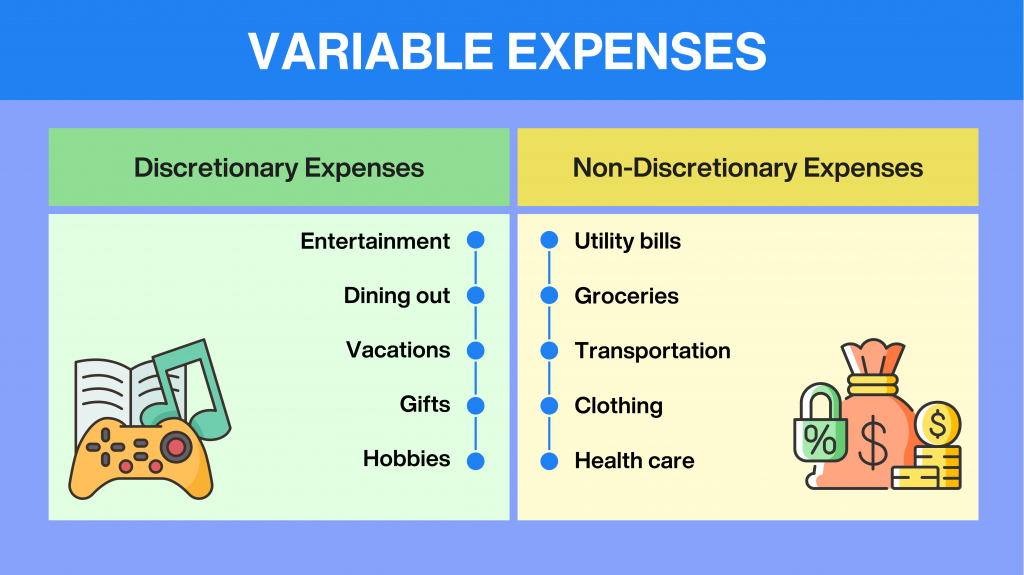

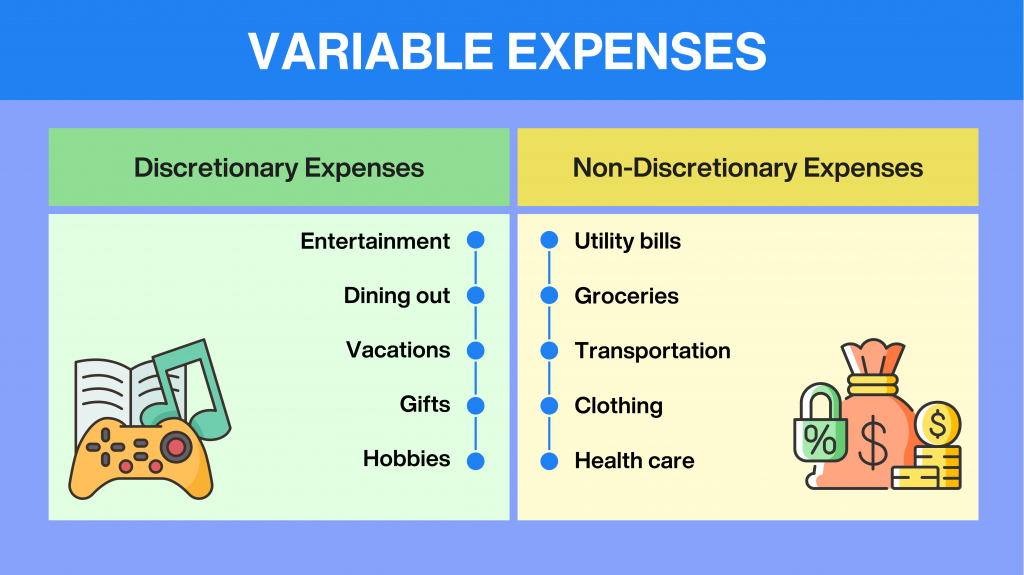

Variable expenses are changing costs that fluctuate from month to month based on your usage, consumption, or lifestyle choices. Unlike fixed expenses, you have significant control over these fluctuating expenses, and they respond directly to your behavior and decisions.

Defining characteristics include:

- Fluctuation: Amounts change monthly based on various factors

- Usage-dependent: Costs correlate with how much you consume or use

- Controllable: You can directly influence the amount through your choices

- Less predictable: Harder to anticipate exact costs in advance

- Discretionary elements: Many (though not all) are non-essential

Common Examples of Variable Expenses

Understanding variable expenses helps clarify why rent doesn’t belong in this category:

- Groceries: Your food spending varies based on dietary choices, household size, and shopping habits ($200-$800/month)

- Utilities (electricity, gas, water): Usage fluctuates with seasons, habits, and household activities ($100-$300/month)

- Gasoline: Depends on how much you drive, fuel prices, and vehicle efficiency ($100-$400/month)

- Dining out and entertainment: Completely discretionary spending that varies with lifestyle ($50-$500/month)

- Clothing purchases: Varies significantly based on needs and shopping frequency ($50-$300/month)

- Home and car repairs: Unpredictable maintenance and emergency costs ($0-$1,000+ sporadically)

- Medical expenses: Out-of-pocket healthcare costs beyond insurance premiums (varies widely)

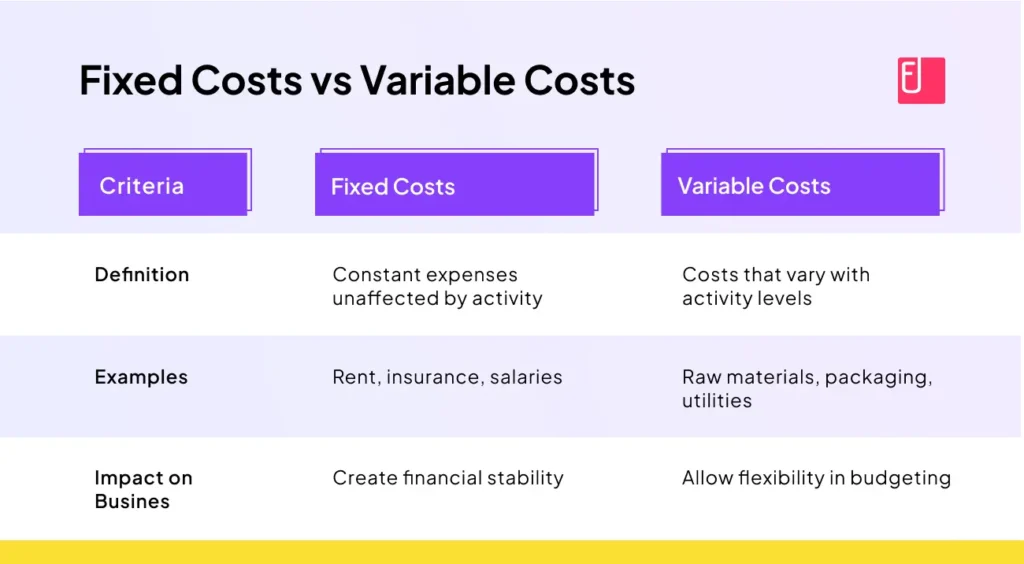

Key Differences Between Fixed and Variable Expenses

Predictability vs. Fluctuation:

- Fixed expenses: You know exactly what you’ll pay months in advance (like your $1,200 monthly rent)

- Variable expenses: Costs change based on consumption (like a $75 electric bill one month and $150 the next)

Budgeting implications:

- Fixed expenses require straightforward allocation—simply reserve the exact amount needed

- Variable expenses demand tracking past spending patterns and creating spending averages to estimate future costs

Control and flexibility:

- Fixed expenses offer limited short-term adjustment options without major life changes

- Variable expenses can be immediately reduced through behavioral modifications and conscious choices

Frequency of payment:

- Fixed expenses typically have regular, consistent billing dates

- Variable expenses may occur irregularly or at unpredictable intervals

How to Budget for Fixed and Variable Expenses

Budgeting for Fixed Expenses (Like Rent)

Fixed expenses like your monthly rent payment should receive priority in budget planning because they’re non-negotiable and predictable. Here’s the strategic approach:

- List all fixed expenses first: Before allocating money elsewhere, identify every recurring cost—rent, mortgage payment, insurance premiums, car payments, loan payments, and subscription services. This creates your baseline budget floor.

- Easier to plan and predict: Since these amounts don’t change, you can automate payments and set aside funds immediately when income arrives. Many people schedule automatic transfers on payday to ensure essential expenses are covered before discretionary spending tempts them.

- Build your budget around fixed costs: Your fixed expenses determine the minimum income you need monthly. If fixed costs exceed 50% of your income, you may need to find ways to reduce them or increase earnings.

Budgeting for Variable Expenses

Variable expenses require a different strategy due to their fluctuating nature:

- Track past spending patterns: Review 3-6 months of bank statements to understand your average spending on groceries, utilities, gasoline, and other changing costs. This historical data reveals realistic spending averages.

- Create spending averages: Calculate monthly averages for each variable expense category. If groceries cost $320, $280, and $350 over three months, budget approximately $315 monthly.

- Build in buffer room: Variable expenses can spike unexpectedly. Add 10-15% cushion to your averages to accommodate fluctuations without derailing your budget. This prevents overspending when utility bills surge during extreme weather or when car repairs arise.

The 50/30/20 Budgeting Rule

This popular framework from Senator Elizabeth Warren provides an effective template for balancing fixed and variable expenses:

- 50% needs (fixed expenses): Allocate half your after-tax income to essential expenses—primarily fixed costs like rent, mortgage payment, insurance premiums, minimum loan payments, and utilities. Your monthly rent payment typically represents the largest portion of this category.

- 30% wants (discretionary): Reserve this portion for variable expenses like dining out, entertainment, hobbies, and non-essential purchases. This category gives you lifestyle flexibility while maintaining financial discipline.

- 20% savings: Direct this amount toward your emergency fund, retirement accounts, and debt payoff beyond minimums. This ensures long-term financial planning remains a priority alongside current expenses.

Common Misconceptions About Rent as an Expense

Several myths perpetuate the confusion about whether rent qualifies as a variable expense:

Misconception #1: “My rent changed, so it must be variable” When rent increases at lease renewal, it establishes a new fixed amount for the next term. Infrequent changes don’t make rent variable—it remains constant throughout each lease period. Variable expenses fluctuate monthly, not annually.

Misconception #2: “I can choose where to live, so rent is discretionary” While you control your initial housing choice, once committed to a lease, the monthly rent payment becomes a fixed obligation. The discretionary decision happens when signing the lease, not when paying each month.

Misconception #3: “Housing costs are variable because utilities change” This conflates total housing costs with rent specifically. Utilities are indeed variable expenses, but your rent payment itself remains fixed. Separating these categories is crucial for accurate budgeting.

Situations where rent might change:

- Lease renewal with adjusted rates

- Moving to a different property

- Adding/removing roommates (changing your share)

- Month-to-month tenancy (though still typically consistent)

Even in these scenarios, rent maintains fixed characteristics during any given period—you’ll know the exact amount for each billing cycle.

Practical Tips for Managing Your Fixed Expenses

While fixed expenses like rent are less flexible than variable costs, you can still optimize them:

How to reduce fixed expenses like rent: Consider these strategies before your next lease renewal:

- Research market rates and negotiate lease terms with your landlord using comparable properties as leverage

- Explore neighborhoods with lower rental costs while maintaining reasonable commute times

- Consider roommates to split rent and reduce your individual fixed expense burden

- Look into rent-controlled areas or income-based housing programs if eligible

- Finding more affordable housing: Moving involves upfront costs but can significantly reduce your largest fixed expense. Calculate the break-even point: if moving costs $2,000 but saves $200 monthly in rent, you’ll recoup the investment in 10 months.

- Cutting unnecessary subscriptions: Review all recurring costs quarterly. Cancel unused gym memberships, streaming services, or subscription boxes. Each $15 monthly subscription represents $180 annually—money better allocated to savings or debt reduction.

- Shopping for better insurance rates: Insurance premiums are fixed expenses you can reduce without lifestyle changes. Compare quotes annually for auto, renters, and health insurance. Bundling policies or increasing deductibles can lower these predictable costs substantially.

Practical Tips for Controlling Variable Expenses

Variable expenses offer immediate opportunities for budget optimization through money management discipline:

- Grocery shopping strategies: Plan weekly menus, create shopping lists, and stick to them religiously. Buy generic brands, use coupons strategically, and avoid shopping when hungry. Meal prepping reduces both food waste and the temptation for dining out—controlling two variable expenses simultaneously.

- Reducing utility bills: Lower these fluctuating expenses through energy-conscious habits: adjust thermostats seasonally, switch to LED bulbs, unplug electronics when not in use, and run dishwashers/laundry with full loads only. These behavioral changes can reduce utility costs by 20-30%.

- Entertainment alternatives: Replace expensive dining out with potluck gatherings, utilize free community events, and leverage library resources for books and movies. These substitutions maintain quality of life while dramatically reducing discretionary spending.

- Tracking spending habits: The simple act of recording every purchase creates awareness that naturally reduces variable expenses. When you must categorize each transaction, you’ll think twice before impulse purchases.

- Using budgeting apps: Tools like Mint, YNAB (You Need A Budget), or EveryDollar automatically categorize transactions, highlight spending trends, and send alerts when approaching category limits. Technology makes controlling changing costs significantly easier.

FAQs About Fixed and Variable Expenses

Can rent ever be considered a variable expense?

No, rent remains a fixed expense because the amount stays constant throughout your lease term, regardless of how this contradicts the variable expense definition.

What if my rent increases annually?

Annual increases establish a new fixed amount for the next period; infrequent adjustments don’t transform rent into a variable expense with monthly fluctuation.

Are utilities fixed or variable expenses?

Utilities are variable expenses because consumption-based costs fluctuate monthly depending on usage, weather, and household habits—unlike your predictable monthly rent payment.

Is a car payment fixed or variable?

Car payments are fixed expenses, as loan agreements specify exact monthly installments that remain unchanged until the loan is satisfied or refinanced.

How do I categorize irregular expenses?

Irregular but predictable costs (annual insurance premiums) are fixed; unpredictable costs (emergency repairs) are variable, though both require planning through savings.

Conclusion

Your monthly rent payment is definitively a fixed expense, not a variable one—a crucial distinction for effective budgeting and financial planning. Understanding the difference between predictable costs like rent and fluctuating expenses like groceries empowers you to allocate resources strategically.

Start categorizing your own expenses today using the 50/30/20 rule, prioritize building an emergency fund for unexpected variable costs, and watch your money management skills transform your financial future.