Budgeting feels overwhelming — but the right percentage-based system changes everything. We break down Dave Ramsey’s recommended budget percentages and the popular 50/30/20 rule side by side. Whether you’re drowning in debt or just starting to manage your money, this comparison will help you pick the method that actually fits your life in 2026.

Table of Contents

What Are Budget Percentages and Why They Matter in 2026

The Purpose of Using Budget Percentages

Budget percentages exist for one simple reason: they take the guesswork out of money management. Instead of staring at a blank spreadsheet wondering where your paycheck went, a percentage-based budget gives you a ready-made framework the moment you sit down to plan.

For beginners especially, budget percentages are a lifeline. They simplify complex financial decisions into bite-sized, actionable steps. You don’t need a finance degree — you just need to know how much you bring home and where each dollar should go.

Beyond simplicity, budget percentages serve as a mirror. They help you identify overspending areas you might never have noticed. If you’re spending 30% of your income on dining out but your recommended food budget is 10-15%, the numbers tell the truth even when your habits don’t. That kind of visibility creates accountability.

When you can see exactly where your money is going against a recommended benchmark, you’re far more likely to make conscious spending choices and stick with them.

How Inflation and 2026 Costs Affect Budget Percentages

The average U.S. household income in 2025 sat around $80,000 annually — roughly $6,667 a month before taxes. But that number doesn’t tell the whole story. With inflation still keeping grocery prices, rent, and utility costs elevated heading into 2026, the purchasing power behind that income has shrunk considerably.

This is exactly why budget percentages need adjustment. A flat 25% toward housing worked beautifully in 2018. In many metro areas in 2026, that same 25% barely covers a one-bedroom apartment. The percentages themselves aren’t broken — they just need to be recalibrated for the reality of today’s cost of living. That’s the core purpose of this guide: to help you take these proven frameworks and make them work for your actual life, not some textbook scenario.

Dave Ramsey’s Recommended Budget Percentages Breakdown

Complete Category-by-Category Guide

Giving (10%)

Dave Ramsey has always placed giving at the very top of his budget — and that’s not an accident. For Ramsey, charitable giving isn’t a line item you add after everything else is covered. It’s a priority that comes first. A significant portion of his philosophy is rooted in religious tithing, which traditionally recommends 10% of income to your church or place of worship. However, Ramsey also emphasizes that giving extends beyond tithing — it includes donations to charities, helping friends or family in need, and contributing to causes you believe in.

One practical bonus that often gets overlooked: charitable contributions are tax-deductible. Depending on your situation, donating 10% could meaningfully lower your taxable income. If you’re currently buried in debt, Ramsey acknowledges that starting with a smaller percentage and gradually working your way up to 10% is perfectly acceptable. The goal is to build the habit, not to create financial stress.

Saving (10-15%)

Saving is where Ramsey’s Baby Steps framework really comes into play. Before you invest a single dollar, Step 1 demands a $1,000 emergency fund — a small financial cushion that keeps you from spiraling back into debt the moment an unexpected expense hits. After that (and after you’ve tackled debt in Step 2), Step 3 pushes you to build a 3-6 month emergency fund covering all your living expenses.

Once those foundations are solid, Ramsey recommends investing 15% of your take-home pay into retirement — typically through tax-advantaged accounts like a 401(k) or Roth IRA. This is where the 10-15% saving category gets its range. Early on, 10% might be realistic. As your debt disappears and your income grows, pushing toward 15% becomes the real goal. Retirement savings percentage isn’t just a number — it’s the engine of long-term financial freedom.

Food (10-15%)

Food is one of the trickiest budget categories because it’s split into two very different buckets: groceries and dining out. Ramsey recommends keeping your total food spending — groceries plus restaurants — between 10% and 15% of your take-home pay. The grocery budget percentage should make up the bulk of that, with dining out being the smaller slice.

Household size matters enormously here. A single person can realistically hit the 10% mark. A family of four will likely land closer to 15%, and that’s okay. Meal planning is the single most effective strategy for staying within this range. When you know exactly what you’re eating for the week, impulse purchases and expensive takeout trips drop dramatically. In 2026, with grocery inflation still lingering, buying seasonal produce, shopping with a list, and using store brands can save a family hundreds of dollars every single month.

Utilities (5-10%)

Your utility budget covers electric, water, gas, internet, and your phone bill. Ramsey keeps this one tight at 5-10%, and for good reason — these are expenses where small changes add up fast. Regional variations play a huge role here. If you live in Phoenix, your electric bill in summer will be far higher than someone in Portland. If you’re in a rural area, internet costs might be steeper due to limited provider options.

Energy-saving tactics aren’t just trendy — they’re financially smart. Switching to LED bulbs, using a programmable thermostat, and being intentional about when you run heavy appliances like dryers and dishwashers can trim 10-20% off your utility bills. Shopping around for budget-friendly providers for internet and phone service is also worth doing once a year, even if it feels tedious.

Housing (25%)

Housing is the single largest category in Dave Ramsey’s budget — and in 2026, it’s also the most challenging one to hit. Whether you’re paying a mortgage or renting, Ramsey recommends keeping your total housing costs at or below 25% of your take-home pay. That includes your mortgage or rent payment, property taxes, HOA fees, and home insurance.

Here’s the hard truth: in cities like San Francisco, New York, Miami, and even mid-sized metros like Austin or Denver, 25% of an average income barely covers a modest apartment. This is the category where you might genuinely need to make lifestyle trade-offs — a longer commute for a cheaper rent, roommates, or relocating to a lower cost-of-living area. Ramsey doesn’t sugarcoat this. He’d rather you stretch your comfort zone than stretch your budget past the breaking point.

Transportation (10%)

Transportation at 10% covers car payments, insurance, gas, and maintenance. Ramsey is famously anti-car-payment. His ideal scenario? You drive a reliable used car that you bought outright with cash. That alone can save you hundreds per month compared to someone making a $400 car payment.

If a car payment is unavoidable right now, keep it as small as possible. Gas and maintenance are the sneaky costs that blow budgets — regular oil changes and tire rotations prevent the expensive breakdowns that eat your emergency fund. Public transportation alternatives can also bring this number down significantly in cities with strong transit systems. Electric vehicle considerations are growing in 2026, and while the upfront cost is higher, lower fuel and maintenance costs can make EVs a smart long-term play within this budget category.

Health (5-10%)

Health spending covers medical expenses, copays, prescriptions, dental, and vision. The 5-10% range reflects a reality that most people don’t want to acknowledge: healthcare costs vary wildly depending on your age, your health, and your insurance situation.

If your employer covers most of your health insurance premium, you might sit comfortably at 5%. If you’re self-employed or dealing with a chronic condition, 10% might not even be enough. HSA (Health Savings Account) and FSA (Flexible Spending Account) strategies are critical here. Both let you set aside pre-tax dollars for qualified medical expenses, effectively reducing what healthcare actually costs you out of pocket.

Insurance (10-25%)

This is one of the widest ranges in Ramsey’s budget, and for good reason. Insurance isn’t one thing — it’s a family of financial safety nets. Life insurance is non-negotiable if anyone depends on your income. Disability insurance protects your ability to earn in the first place. Umbrella policies add an extra layer of liability coverage beyond your home and auto policies.

What’s NOT included here: health insurance (that lives in the Health category) and home insurance (that’s folded into Housing). The wide 10-25% range exists because your insurance needs change dramatically based on your life stage. A single person with no dependents might be at 10%. A family with young kids and a mortgage might push toward 20% or higher.

Recreation/Entertainment (5-10%)

Budget purists sometimes flinch at this category, but Ramsey includes it deliberately. A budget with zero room for fun is a budget that fails. Recreation and entertainment cover hobbies, subscriptions, vacations, travel, family activities, and yes — your streaming services.

The key is intentionality. Streaming services alone can quietly eat $50-100 a month if you’re not paying attention. Vacations don’t have to be expensive — planning ahead, traveling off-peak, and saving a little each month into this category means you can enjoy life without blowing your budget.

Personal Spending (5-10%)

Personal spending is your individual discretionary money. Clothing, accessories, haircuts, grooming, and personal care items all live here. This category is deeply personal — what one person considers essential, another considers a luxury.

The practical advice? Track what you actually spend in this category for a month before you set a percentage. You might be shocked at how much adds up. Once you see the real number, trimming it becomes much easier.

Miscellaneous (5-10%)

Think of miscellaneous as your budget’s shock absorber. Gifts and celebrations, professional development, one-time purchases, and anything that doesn’t fit neatly into another category lands here. This buffer for unexpected expenses is what keeps you from raiding your emergency fund every time something unpredictable pops up — and something always does.

Debt (Varies — As Much As Possible)

This is the category that sets Dave Ramsey apart from almost every other budgeting expert. He doesn’t assign a fixed percentage to debt — he says throw as much as possible at it. That’s not a typo. Ramsey’s debt snowball method means listing your debts from smallest to largest balance, attacking the smallest one with everything you’ve got while paying minimums on the rest, then rolling that payment into the next debt once it’s gone.

The psychology behind this is powerful. Seeing debts disappear — one after another — builds momentum and motivation. It’s a temporary sacrifice mindset. Ramsey openly tells people: “Live like no one else now, so you can live like no one else later.” Debt elimination isn’t a background activity in his philosophy. It’s the main event.

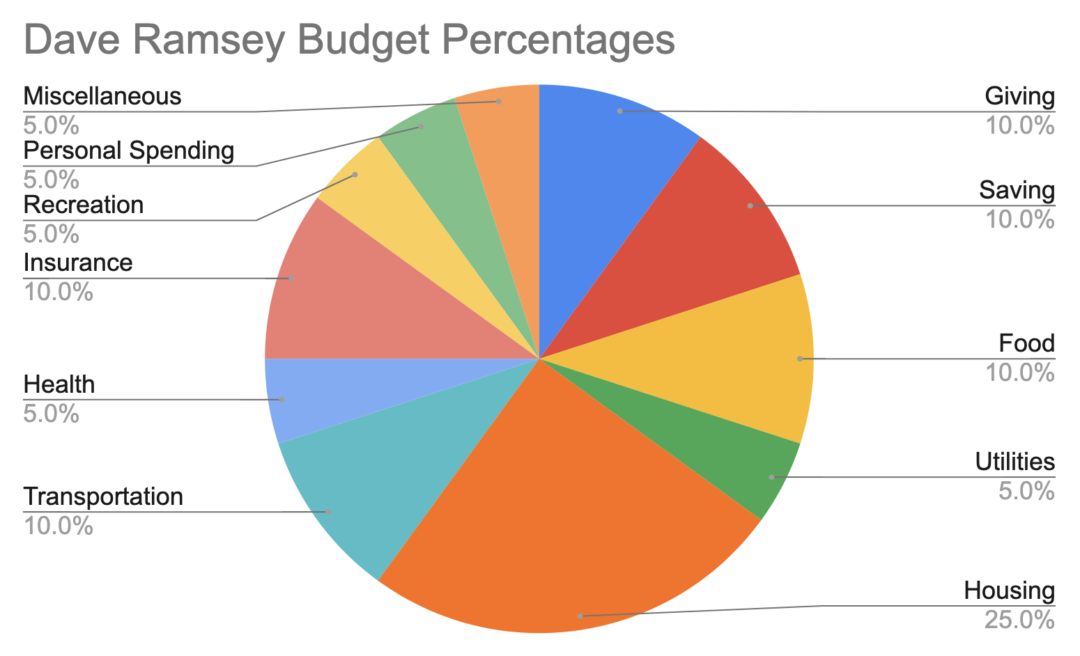

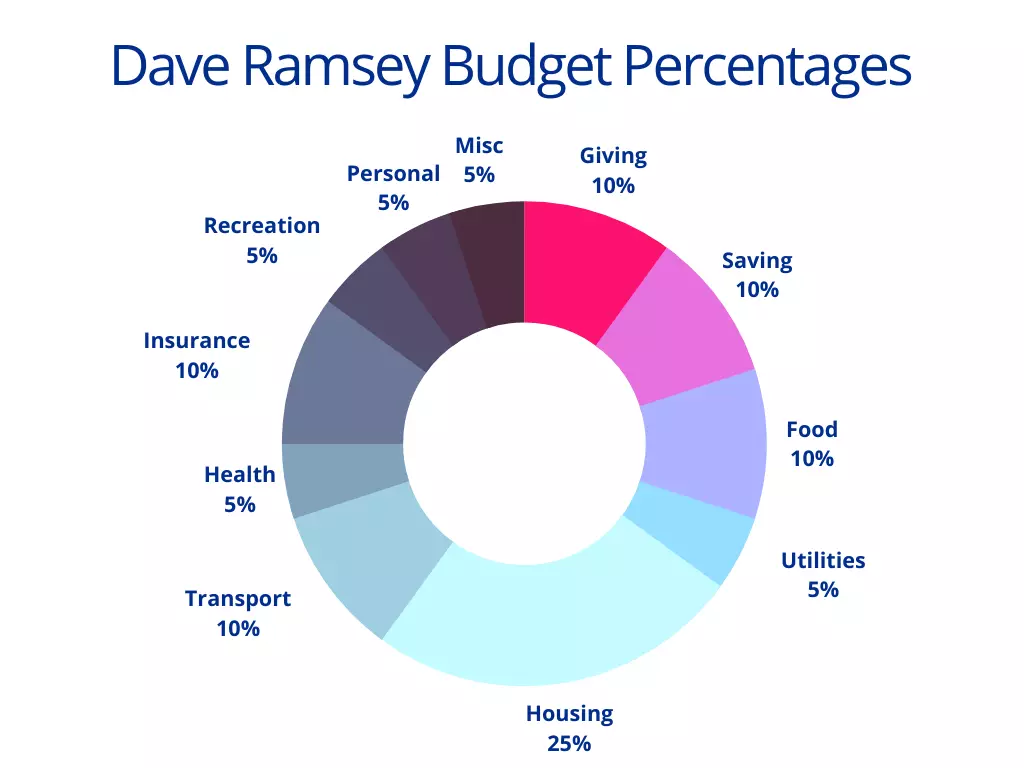

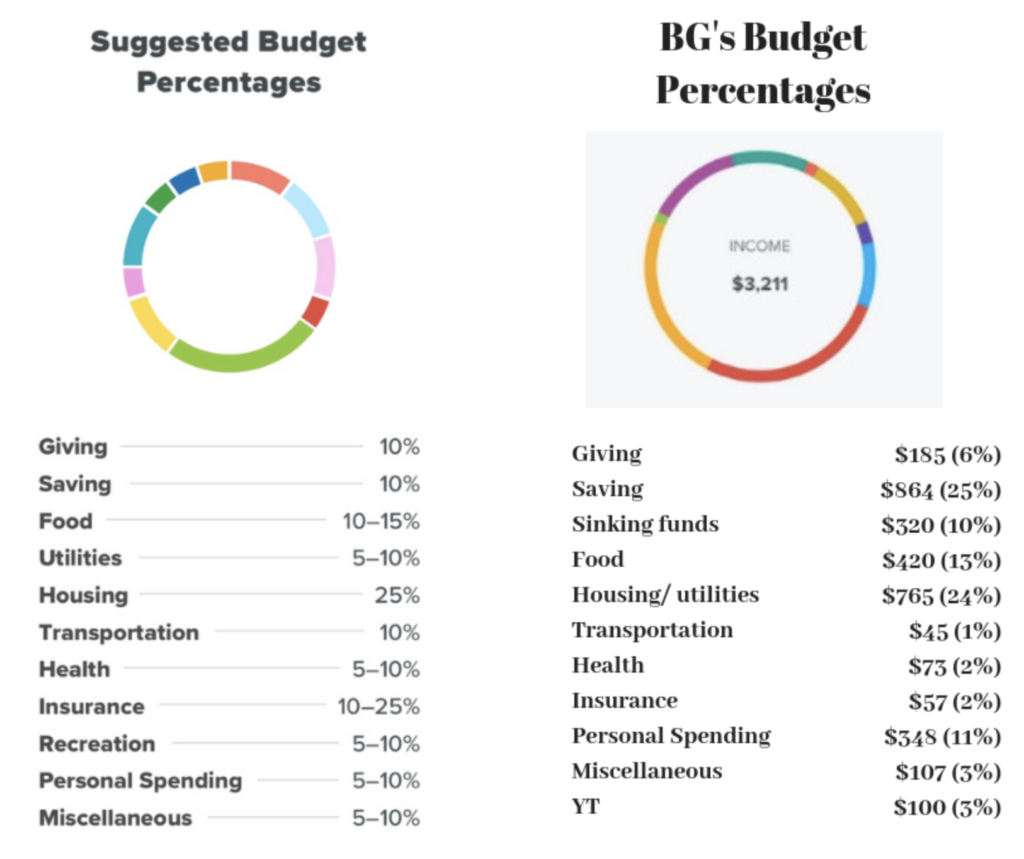

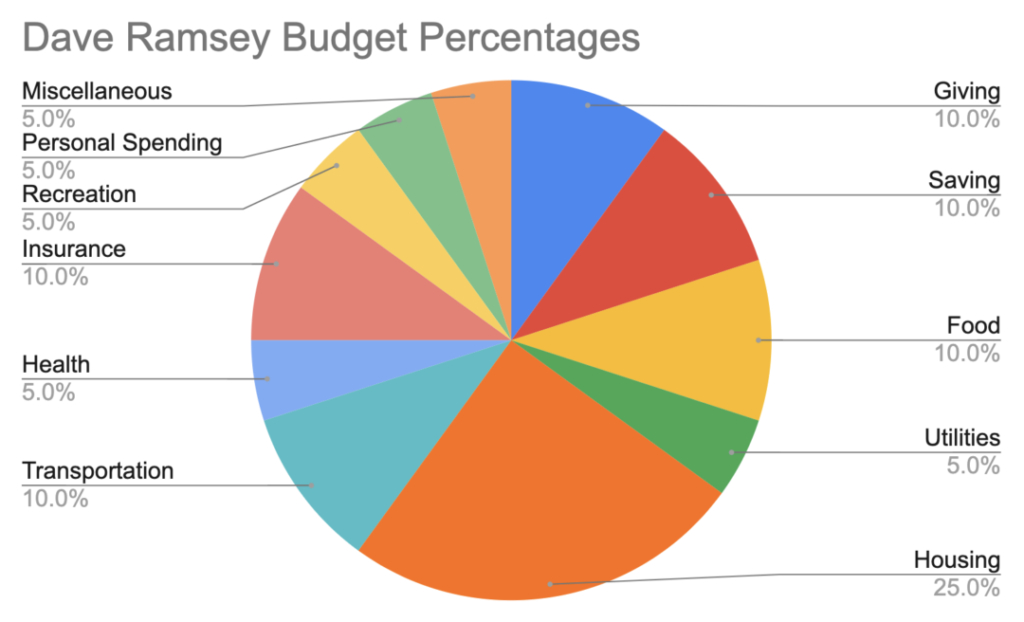

Visual Breakdown Chart

| Category | Ramsey % |

|---|---|

| Giving | 10% |

| Saving/Investing | 10-15% |

| Food | 10-15% |

| Utilities | 5-10% |

| Housing | 25% |

| Transportation | 10% |

| Health | 5-10% |

| Insurance | 10-25% |

| Recreation | 5-10% |

| Personal | 5-10% |

| Miscellaneous | 5-10% |

| Debt | As much as possible |

The 50/30/20 Budget Rule Explained

How the 50/30/20 Rule Works

The 50/30/20 rule is elegantly simple. Take your after-tax income and split it three ways: 50% goes to needs, 30% goes to wants, and 20% goes to savings and debt repayment. That’s it. No eleven categories, no agonizing over whether a gym membership is “health” or “recreation.”

The 50% Needs bucket covers everything essential to survival and stability: rent or mortgage, groceries, utilities, transportation, insurance, and minimum debt payments. The 30% Wants bucket is your life enjoyment fund — dining out, subscriptions, hobbies, travel, and anything that makes life fun but isn’t strictly necessary. The 20% Savings and Debt bucket is where your emergency fund, retirement contributions, and extra debt payments live.

This framework was popularized by Elizabeth Warren, the Harvard bankruptcy expert and U.S. Senator, who introduced it as a way to help average Americans understand where their money should go without needing a financial advisor.

Pros of the 50/30/20 Method

Simplicity is the biggest selling point. Three categories. One rule. You can set up a 50/30/20 budget in ten minutes flat. For someone who’s never budgeted before, this low barrier to entry is genuinely valuable — it removes the intimidation factor entirely.

The method is also less restrictive than most budgeting systems. There’s no guilt attached to spending 30% on things you enjoy, because it’s built right into the plan. This flexibility makes it particularly good for high earners, whose wants spending might look excessive on paper but still leave plenty for savings. And the wants category itself is flexible — you decide what fills it, which means the budget bends to your lifestyle instead of demanding your lifestyle bend to it.

Cons of the 50/30/20 Method

Here’s where honesty matters. For the average American family in 2026, spending only 50% on needs is genuinely difficult. Housing alone can eat 30-35% of income in many cities. Add groceries, utilities, car payments, and insurance, and 50% disappears before you blink.

The method also doesn’t prioritize debt elimination the way Ramsey does. Tucking debt repayment into the 20% savings bucket alongside retirement contributions means your debt payoff timeline stretches out. And 20% savings — while better than nothing — may not be enough to build real wealth over time, especially if you start late.

The lack of granular guidance is another weakness. Knowing you have 30% for “wants” doesn’t tell you whether your subscription habit or your dining-out habit is the problem. You still have to dig into the details yourself.

Dave Ramsey Budget Percentages vs 50/30/20 Rule: The Ultimate Comparison

Side-by-Side Comparison Table

| Feature | Dave Ramsey | 50/30/20 Rule |

|---|---|---|

| Number of Categories | 11-12 | 3 |

| Complexity Level | Moderate-High | Very Low |

| Debt Strategy | Aggressive (Snowball) | Moderate |

| Savings Target | 10-15% (then 15% investing) | 20% (savings + debt) |

| Housing Guideline | 25% | Part of 50% Needs |

| Giving/Charity | Built in at 10% | Player’s choice |

| Best For | Debt elimination, discipline | Beginners, flexibility |

| Origin | Financial Peace University | Elizabeth Warren |

| Lifestyle Flexibility | Lower | Higher |

| Long-Term Wealth Building | Very Strong | Moderate |

Real-Life Example: $5,000 Monthly Income

Let’s put both methods to work with a concrete take-home pay of $5,000 per month.

Dave Ramsey Allocation:

| Category | Amount ($) | Percentage (%) |

|---|---|---|

| Giving | 500 | 10 |

| Saving | 500 – 750 | 10 – 15 |

| Food | 500 – 750 | 10 – 15 |

| Utilities | 250 – 500 | 5 – 10 |

| Housing | 1,250 | 25 |

| Transportation | 500 | 10 |

| Health | 250 – 500 | 5 – 10 |

| Insurance | 500 – 750 | 10 – 15 |

| Recreation | 250 – 500 | 5 – 10 |

| Personal | 250 – 500 | 5 – 10 |

| Miscellaneous | 250 – 500 | 5 – 10 |

| Debt | Remaining | Remaining |

50/30/20 Allocation:

| Category | Percentage | Amount |

|---|---|---|

| Needs | 50% | $2,500 |

| Wants | 30% | $1,500 |

| Savings + Debt | 20% | $1,000 |

Which leaves more for goals? It depends on your goal. If your goal is eliminating debt fast, Ramsey wins — because every dollar not locked into a fixed category can go straight to debt. If your goal is lifestyle balance with moderate savings, 50/30/20 gives you more breathing room.

Over 12 months, the Ramsey approach with aggressive debt payoff could eliminate $3,000-6,000 more in debt than the 50/30/20 method, simply because Ramsey demands you direct surplus money toward payoff rather than splitting it between savings and lifestyle.

Real-Life Example: $3,000 Monthly Income

At $3,000 a month, both methods feel the squeeze. This is where budget reality gets uncomfortable.

- Dave Ramsey at $3,000: Housing at 25% means $750. In most cities, that’s not realistic for a private apartment. Food at 10% is $300 — tight for a family, possible for a single person. Giving at 10% ($300) might need to drop to 5% until debt is gone. Ramsey himself acknowledges that his percentages are guidelines, not gospel, for people in financial crisis.

- 50/30/20 at $3,000: Needs at 50% is $1,500. That’s barely enough to cover rent plus basics in most areas. Wants at 30% ($900) might be the first thing that needs to shrink. Savings at 20% ($600) sounds healthy on paper, but if your needs genuinely cost $1,800, you’re already over before you start.

Where each method falls short at this income level is the same place: the math doesn’t bend for high cost-of-living areas. Necessary adjustments include finding roommates, relocating, or supplementing income. Realistic expectations mean accepting that at $3,000 a month, the priority is survival and small, consistent progress — not perfection.

Which Method Wins for Different Situations?

- Best for People in Debt: Dave Ramsey, without question. His debt snowball method combined with aggressive payoff mentality is specifically designed to destroy debt fast. The 50/30/20 rule treats debt as an afterthought inside the 20% bucket.

- Best for High-Income Earners: 50/30/20 works beautifully here. When your income is high enough that 50% genuinely covers all needs with room to spare, the flexibility of 30% wants and 20% savings feels liberating rather than reckless.

- Best for Families: Ramsey’s detailed categories give families better control over the many moving parts of a household budget — food, health, transportation, insurance all get their own allocation. 50/30/20 can feel too vague when you’re juggling kids, cars, and college savings.

- Best for Singles: Either works well. Singles tend to have fewer fixed expenses and more flexibility. 50/30/20 is easier to set up quickly, while Ramsey’s system is better if you have student loans or other debt to crush.

- Best for Retirees: The 50/30/20 rule adapts more naturally to a fixed income because it’s percentage-based and flexible. Retirees don’t typically have debt snowballs to tackle, so Ramsey’s aggressive debt focus becomes less relevant.

- Best for Beginners: 50/30/20 is the gentler on-ramp. It’s simple, forgiving, and doesn’t require tracking eleven categories. Once you’re comfortable budgeting, graduating to Ramsey’s system adds the granularity you’ll need for serious wealth building.

Common Mistakes When Using Budget Percentages

Mistake 1: Treating Percentages as Absolute Rules

Budget percentages are starting points, not commandments. If your housing costs 30% of your income because you live in Seattle, that’s not a failure — it’s geography. The moment you treat these numbers as rigid laws, you set yourself up for frustration and abandonment. Flexibility within a framework is what makes budgeting sustainable.

Mistake 2: Ignoring Your Actual Expenses

Many people set up a budget based on recommended percentages and never check what they actually spend. Two weeks in, reality hits and the budget falls apart. Before you assign a single percentage, track your real spending for at least 30 days. The numbers you find will be far more useful than any textbook recommendation.

Mistake 3: Not Adjusting for Cost of Living

A budget built for someone in Tulsa will not work in Honolulu. Cost of living varies enormously across the country, and budget percentages need to reflect that. Housing, groceries, transportation, and utilities all shift dramatically based on where you live. Ignoring this is one of the fastest ways to feel like budgeting is “impossible.”

Mistake 4: Forgetting Irregular Expenses

Car registration. Annual insurance premiums. Birthday gifts. Holiday travel. These expenses don’t show up every month, but they show up every year — and if you don’t plan for them, they blow your budget wide open. Set aside money monthly for irregular expenses, even if the expense itself is six months away.

Mistake 5: Staying Rigid When Life Changes

You got married. You had a baby. You lost your job. Life doesn’t pause to let your budget stay neat and tidy. A good budget is a living document. When your circumstances change, your percentages change too. Stubbornly clinging to last year’s numbers when this year looks completely different is a recipe for financial stress.

How to Customize Budget Percentages for Your Life

Step 1: Calculate Your True Take-Home Pay

This is your starting line. Not your gross salary — your actual take-home pay after taxes, insurance deductions, and anything else your employer withholds. This is the number every percentage is calculated against. If you’re self-employed, average your last 3-6 months of income to get a realistic monthly figure.

Step 2: Track Current Spending for 30 Days

Don’t guess. Don’t estimate. Actually track every dollar you spend for a full month. Use an app, a spreadsheet, or even pen and paper. The goal isn’t to judge yourself — it’s to see the truth. You cannot fix what you cannot see.

Step 3: Compare Against Recommended Percentages

Now lay your real spending next to Ramsey’s percentages (or 50/30/20, whichever you’re testing). Where are you over? Where are you under? This comparison is where the real insight lives. It shows you exactly which categories need attention and which are already healthy.

Step 4: Identify Problem Areas

Usually, one or two categories are dramatically over the recommended percentage. Maybe it’s food. Maybe it’s entertainment. Maybe it’s impulse purchases hiding in “miscellaneous.” Name them. Awareness is the first and most powerful step toward change.

Step 5: Create Your Personalized Plan

Now build your budget. Start with the categories that are already working and keep them. For the problem areas, set a realistic target — not the ideal percentage, but a number that’s better than where you are now. Progress beats perfection every single time.

Step 6: Test and Adjust Monthly

Your first budget will not be perfect. That’s expected. Give it one full month, then sit down and review. What worked? What blew up? Adjust and try again. Budgeting is a skill, and like any skill, it gets better with practice.

Budget Adjustment Scenarios

- Living in high-cost cities: Housing may need to jump to 30-35%. Compensate by trimming recreation, personal spending, and dining out. The math has to balance somewhere.

- Single income vs dual income: Single-income households have far less margin for error. Every percentage needs to be tighter. Dual-income households have more room to allocate toward savings and debt payoff.

- Supporting elderly parents: This often shows up as an unexpected expense that doesn’t fit neatly into any category. Build it into your miscellaneous or create its own line item. Don’t pretend it’s not there.

- Medical challenges: Health spending may blow past 10%. That’s okay. Adjust other flexible categories — recreation, personal spending, and dining out — to absorb the difference. Your health is not a line item you can cut.

- Student loan burden: This is where Ramsey’s debt snowball philosophy becomes critical. Student loans can consume 10-20% of income on their own. Make them a named priority in your budget, not an invisible background expense.

Tools and Resources to Implement Your Budget

Best Budgeting Apps for 2026

- EveryDollar is Dave Ramsey’s own budgeting app, and it’s built specifically around his zero-based budgeting philosophy. Every dollar of your income gets assigned a job — a category, a purpose. The free version is solid. The premium version (bundled with Financial Peace University) adds bank syncing and extra features.

- YNAB (You Need A Budget) is the strongest competitor. It teaches zero-based budgeting beautifully and has an exceptionally active community. It costs money, but users consistently report that it pays for itself within the first month. Great comparison point if you’re weighing EveryDollar vs YNAB.

- Mint alternatives have multiplied since Mint shut down. Apps like Monarch Money and Copilot have stepped in with strong expense-tracking features. They’re excellent for the tracking phase — when you’re figuring out where your money actually goes before you build a formal budget.

Free vs paid options: if budget is a concern (which it probably is, since you’re reading a budgeting article), start with free tools. EveryDollar’s free version and a basic spreadsheet will get you 90% of the way there.

Budget Templates and Calculators

Downloadable spreadsheets are everywhere online — Google Sheets templates are particularly flexible and free. Printable worksheets work well for people who think better on paper. Online calculators let you plug in your income and instantly see recommended allocations under both Ramsey’s system and 50/30/20. Mobile-friendly tools matter if you’re going to actually use them — a budget you never open is useless.

Dave Ramsey Baby Steps Quick Reference

- Step 1: Save $1,000 as a starter emergency fund. This is your first financial safety net.

- Step 2: Attack debt using the debt snowball method — smallest balance first, maximum payments, build momentum.

- Step 3: Build a full 3-6 month emergency fund covering all living expenses.

- Steps 4-7: Invest 15% in retirement (Step 4), save for kids’ college (Step 5), pay off your home (Step 6), and build wealth and give generously (Step 7). These are the long game. Baby Steps budgeting is the roadmap — simple, sequential, and powerful.

Action Plan: Your First 30 Days

Week 1: Assessment Phase

This week is about gathering information, nothing else. Calculate your take-home pay. Pull up your bank and credit card statements from the last two months. Start tracking every expense — even the small ones. Don’t change anything yet. Just observe.

Week 2: Planning Phase

Now you have data. Sit down with your spending from Week 1 and compare it to both Ramsey’s budget percentages and the 50/30/20 rule. Decide which framework resonates more with your personality and situation. Write down your goals: Are you focused on debt? Savings? Both? Your goals determine how you allocate.

Week 3: Implementation Phase

Build your first budget. Assign percentages to each category based on the framework you chose. Set up your budgeting app or spreadsheet. If you’re using the envelope system (physical cash in labeled envelopes for each category), set that up now. Start living by the budget. It will feel awkward. That’s normal.

Week 4: Review and Adjust

Sit down at the end of the month. Be honest about what happened. Where did you stick to the plan? Where did you deviate? Why? This isn’t about guilt — it’s about learning. Adjust your percentages, note what worked, and carry those lessons into Month 2. Budgeting that actually works is built one month at a time.

Frequently Asked Questions

Is the Dave Ramsey budget too strict?

It can feel strict at first, but that strictness is the point. It forces you to prioritize and make trade-offs — which is exactly how people get out of debt and build real wealth.

Can I combine Dave Ramsey percentages with 50/30/20?

Absolutely. Use 50/30/20 as your high-level framework and Ramsey’s categories to break down the 50% Needs and 30% Wants into more specific buckets.

What if my housing is more than 25%?

Adjust other flexible categories to compensate. Housing at 30-35% is a reality for millions of Americans. The key is making sure your total budget still balances.

How do I handle irregular income?

Average your last 3-6 months of income and budget based on the lowest month. Any extra income in higher months goes straight to savings or debt payoff.

Should I follow percentages on gross or net income?

Always net income — your actual take-home pay after taxes. Budgeting on gross income is a fast way to come up short every single month.

What if I’m self-employed?

Budget based on your lowest income month from the past six months. Set aside 25-30% for taxes first, then apply your chosen budget percentages to what remains.

How often should I update my budget percentages?

At minimum, every quarter. After any major life change — new job, marriage, baby, move — update immediately.

What’s the biggest difference between these methods?

Granularity and debt strategy. Ramsey gives you 11 categories and an aggressive debt payoff plan. 50/30/20 gives you 3 broad buckets and lets you decide how to handle debt within the 20% savings category.

Which budget method helps pay off debt faster?

Dave Ramsey’s method, decisively. The debt snowball combined with “throw everything at debt” mentality eliminates debt significantly faster than 50/30/20’s more moderate approach.

Can budget percentages work with variable income?

Yes — budget based on your lowest expected income month. When higher-income months come in, direct the surplus to your top financial priority: emergency fund, debt, or investments.

Final Verdict: Which Budget Method Should You Choose in 2026?

Quick Decision Matrix

- Your current financial situation: If you’re carrying significant debt — credit cards, car loans, student loans — Dave Ramsey’s system is built for you. If you’re relatively debt-free and just want a clean, simple way to manage money, 50/30/20 is plenty.

- Your personality type: If you’re detail-oriented and thrive with structure, Ramsey’s category-by-category approach will feel like home. If you prefer simplicity and resist anything that feels like too much homework, 50/30/20 respects your time and energy.

- Your goals timeline: Short-term goal of debt freedom? Ramsey. Long-term goal of general financial wellness with moderate effort? 50/30/20. Both methods build wealth — they just take different paths to get there.

- Your commitment level: Be honest with yourself. A budget you actually follow beats a perfect budget you abandon in two weeks. Start where you are. If 50/30/20 gets you started and builds the habit, that’s a win. Once budgeting feels natural, layer in Ramsey’s detail for the next level of financial control.

Conclusion

There is no single “best” budget method — there’s only the one you’ll actually use. Dave Ramsey’s budget percentages offer depth, discipline, and a clear debt-destruction roadmap. The 50/30/20 rule offers simplicity, flexibility, and a low-pressure entry point. Both are proven. Both work. The real victory in 2026 isn’t picking the perfect system — it’s picking one, starting today, and adjusting as you go.