Imagine checking your 401k balance and seeing seven figures staring back at you. It’s not a fantasy reserved for high earners—it’s achievable for ordinary people following a proven plan.

Dave Ramsey’s approach to retirement investing has helped countless Americans become 401k millionaires through consistent contributions and smart decisions. His famous 15 percent rule, combined with the power of compound interest retirement growth, creates a roadmap anyone can follow.

This guide reveals how to use a Dave Ramsey 401k calculator effectively, understand 2026 contribution limits, and calculate your personal timeline to millionaire status using the Ramsey retirement calculator methodology.

Table of Contents

What Is Dave Ramsey’s 401K Investment Philosophy?

The Baby Steps Foundation

Dave Ramsey doesn’t recommend jumping into 401k investing while you’re drowning in debt. His Baby Steps framework places retirement investing at Baby Step 4—only after you’ve paid off all debt except your mortgage and built an emergency fund.

This sequencing isn’t arbitrary; it’s strategic. When you’re debt-free, every dollar you invest stays invested instead of being pulled out during emergencies. This foundation ensures your retirement contributions remain consistent, which is critical for long-term wealth building.

Many people make the mistake of investing for retirement while still making car payments or carrying credit card balances. The interest you’re paying on debt typically exceeds what you’ll earn in the market, making it mathematically unwise to invest before becoming debt-free.

The 15 Percent Rule Explained

The cornerstone of Dave Ramsey’s retirement strategy is investing 15% of your gross household income into retirement accounts once you reach Baby Step 4. This isn’t 15% of your take-home pay—it’s 15% of your income before taxes. For a household earning $80,000 annually, that’s $12,000 per year or $1,000 monthly going toward retirement.

Why exactly 15%? Ramsey calculated this as the sweet spot that balances building substantial retirement wealth while still having income available for Baby Step 5 (college funding for kids) and Baby Step 6 (paying off your mortgage early). It’s not about maxing out your 401k during this phase—it’s about balanced wealth building across multiple financial goals.

This differs dramatically from conventional advice that often suggests contributing the maximum allowed to your 401k regardless of other financial priorities. Ramsey’s approach acknowledges that life has multiple financial demands, and retirement investing should be substantial but not all-consuming during your prime earning years.

Dave Ramsey’s Investment Preferences

When it comes to what to invest in within your 401k, Dave Ramsey advocates for growth stock mutual funds rather than individual stocks or bonds. He recommends spreading your investments across four categories: growth, growth and income, aggressive growth, and international funds. This diversification strategy, combined with actively managed mutual fund growth options, aligns with his belief that professional fund managers can outperform passive index funds over time.

Ramsey is notably skeptical of target-date funds, which automatically adjust your asset allocation as you age. He prefers investors maintain control over their investment choices rather than letting an automated formula make decisions. For those who want professional guidance on selecting specific funds, Ramsey Solutions offers the SmartVestor Pro service, connecting investors with financial advisors in their area who share his investment philosophy.

How to Use a 401K Calculator the Dave Ramsey Way

Key Inputs You Need

To accurately project your retirement savings using a 401k investment calculator, you’ll need several specific data points. Start with your current age and your planned retirement age—most people use 65 or 67, but this is personal to your goals. Next, enter your current 401k balance if you have one. If you’re starting from zero, that’s perfectly fine and actually makes the calculation simpler.

Your annual household income is crucial because it determines your 15% contribution amount. If you and your spouse both work, combine both incomes. Next, identify your employer match percentage—this is free money that dramatically accelerates your timeline to millionaire status. Finally, you’ll need to choose an expected rate of return, which significantly impacts your projected balance.

Don’t forget to account for whether you’re using a traditional 401k or Roth 401k option, as this affects the tax treatment of your contributions and withdrawals, though it doesn’t change the growth calculation in most basic calculators.

Setting Realistic Rate of Return Expectations

Dave Ramsey frequently references historical stock market returns of 10-12% when discussing investment rate of return expectations. This is based on the S&P 500’s long-term average performance. However, using 12% in your Ramsey 401k calculator might set you up for disappointment, while using 4% is unnecessarily pessimistic for a multi-decade investment horizon.

Most financial professionals suggest using 7-10% for long-term projections when calculating 401k growth. This accounts for market volatility, economic downturns, and the reality that past performance doesn’t guarantee future results. The number you choose dramatically affects your monthly contribution calculator results—the difference between assuming 7% and 12% returns can mean hundreds of thousands of dollars in projected final balance.

I recommend running calculations at both 8% (conservative) and 10% (moderate) to give yourself a realistic range of outcomes. This way, you’re not crushed if returns are lower than expected, but you’re also not over-saving if markets perform well.

Factoring In Employer Match

Your employer match is genuinely free money—it’s part of your compensation package that you’re leaving on the table if you don’t contribute enough to capture it fully. Most companies offer matches structured like “50% of the first 6% you contribute” or “100% match up to 3% of salary.”

Let’s say you earn $75,000 and your company matches 50% of your first 6% contributed. If you contribute 6% ($4,500), your employer adds $2,250. That’s an immediate 50% return on your contribution before any market growth occurs. When using a Dave Ramsey retirement calculator, always include the employer match in your total annual contribution amount.

Ramsey’s advice is crystal clear: always contribute at least enough to get the full employer match percentage, even if you’re still working through the earlier Baby Steps. This is the one exception to his “get out of debt first” philosophy because the match represents such a substantial guaranteed return.

2026 401K Contribution Limits You Need to Know

Standard Contribution Limits for 2026

The IRS sets annual contribution limits for tax-deferred retirement accounts, and these numbers typically increase every few years to account for inflation. For 2026, the employee contribution maximum for 401k plans is $23,500 (up from $23,000 in 2024). This is the amount you can personally contribute from your paycheck.

The combined employee plus employer maximum—which includes your contributions, employer match, and any profit-sharing—is $70,000 for 2026. This combined limit rarely affects average earners but matters for high-income individuals with generous employer contributions.

These annual contribution limits have steadily increased over the past decade, reflecting recognition that Americans need to save more for longer retirements. When planning how much to invest in 401k accounts using a Ramsey 401k contribution calculator 2026, always verify you’re using the current year’s limits for accurate projections.

Catch-Up Contributions for Those 50 and Older

Once you turn 50, the IRS allows additional catch-up contributions to help you accelerate retirement savings in your final working years. For 2026, those age 50 and older can contribute an extra $7,500 beyond the standard limit, bringing their total personal contribution to $31,000.

The SECURE 2.0 Act introduced a new provision for ages 60-63, allowing even higher catch-up contributions during these peak earning years. For 2026, those in this age bracket can contribute an additional $11,250 instead of the standard $7,500 catch-up amount.

This age-based boost recognizes that many people get serious about retirement savings later in life, perhaps after finishing college tuition payments or paying off their mortgage. The catch-up provisions give you a chance to compensate for lost time, though starting earlier is always more powerful due to compound interest.

How Contribution Limits Affect Your Calculator Results

When you’re projecting your path to becoming a 401k millionaire, using outdated contribution limits will throw off your entire calculation. If you’re using a Dave Ramsey investment growth calculator designed for 2024 but planning for 2026 and beyond, you’re underestimating what you can actually contribute.

Additionally, most calculators should account for future limit increases. If you’re 35 today and planning to retire at 65, contribution limits will likely increase multiple times over those 30 years. Conservative calculators assume limits stay flat, while more sophisticated tools project reasonable increases, which can add tens of thousands to your final balance.

Always specify your current age in the calculator so it can apply catch-up contributions at the appropriate time. A 48-year-old using a retirement savings growth calculator should see their contribution capacity jump in two years when they hit 50.

Calculate Your Path to One Million Dollars

Starting in Your 20s Scenario

Let’s look at Sarah, age 25, earning $55,000 annually with no current 401k balance. Following the 15 percent rule, she’ll contribute $8,250 per year ($687.50 monthly). Her employer matches 50% of the first 6%, adding another $1,650 annually, bringing her total annual investment to $9,900.

Assuming an 8% average investment rate of return over 40 years until retirement at 65, Sarah’s 401k will grow to approximately $2.59 million. Even using a more conservative 7% return, she’d reach $2.04 million. This demonstrates the extraordinary power of compound interest retirement savings when you start young.

Sarah becomes a 401k millionaire around age 57—after just 32 years of consistent investing. If she bumps her returns assumption to 9%, she hits millionaire status even earlier, around age 54. The timeline to millionaire status is remarkably achievable when you give compound interest decades to work.

The mathematical magic here is that Sarah’s actual contributions total only $396,000 over 40 years ($9,900 × 40). The remaining $2.2 million is pure investment growth—money her money earned.

Starting in Your 30s Scenario

Now consider Marcus, age 35, earning $70,000 with a current 401k balance of $25,000. His 15% contribution is $10,500 annually, and with a 4% employer match ($2,800), his total annual investment is $13,300 ($1,108 monthly).

With 30 years until retirement at 65 and assuming 8% returns, Marcus will accumulate approximately $2.18 million. He crosses the millionaire threshold around age 56—after 21 years of consistent contributions. This still demonstrates the achievable timeline even when starting a decade later than Sarah.

Using a more conservative 7% return assumption, Marcus still reaches approximately $1.72 million, falling just short of the $2 million mark but still building substantial retirement wealth. The key message: starting in your 30s still provides plenty of runway for millionaire status as long as you’re consistent and properly invested.

Marcus’s scenario shows that even with a decade less time to invest, following Dave Ramsey’s 15 percent rule with consistent mutual fund growth produces excellent outcomes.

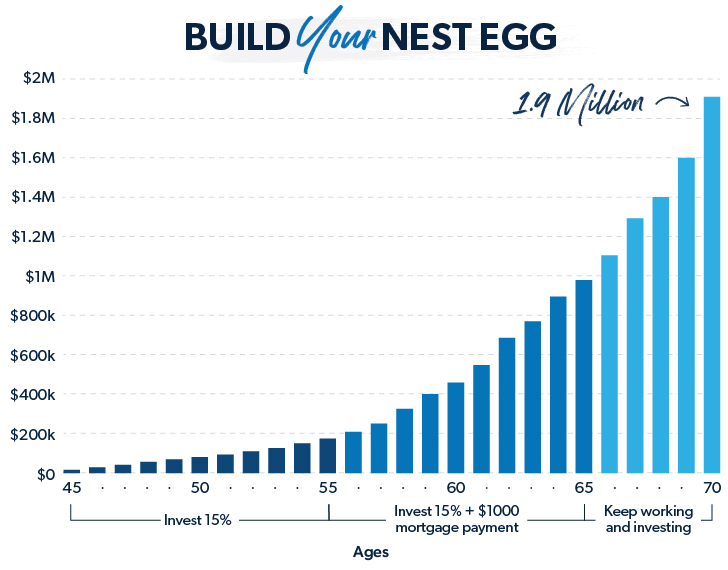

Starting in Your 40s Scenario

Jennifer is 45, earning $85,000, with $75,000 already in her 401k. She commits to the 15% rule ($12,750 annually) plus her employer’s 5% match ($4,250), totaling $17,000 per year in contributions.

With 20 years until 65 and assuming 8% returns, Jennifer projects to $1.46 million. She reaches millionaire status around age 60—still five years before planned retirement. However, if returns average just 7%, she finishes with approximately $1.19 million, falling slightly short of the million-dollar milestone by traditional retirement age.

Jennifer’s scenario highlights the importance of maximizing contributions in your 40s. If she takes advantage of catch-up contributions starting at 50, bumping her personal contribution higher, she can more comfortably reach millionaire status even with conservative return assumptions.

The message for 40-somethings: you haven’t missed the boat, but you need to be aggressive and consistent. This is not the time for “I’ll increase contributions next year”—the time is now.

Starting in Your 50s Scenario

Robert is 55, earning $95,000, with $200,000 in his 401k. He contributes 15% ($14,250) plus employer match of 6% ($5,700), totaling $19,950 annually. Crucially, he also maxes out catch-up contributions, adding the full additional amount allowed for those over 50.

With catch-up contributions, Robert can contribute up to $31,000 from his own paycheck (using 2026 limits), plus the $5,700 employer match, for a combined $36,700 annually. This aggressive saving, combined with his existing $200,000 base and 10 years until 65, projects to approximately $1.13 million at 8% returns.

Robert won’t quite reach millionaire status before 65 with standard 15% contributions, but by maximizing catch-up provisions, he crosses that threshold. His scenario demonstrates that even starting serious retirement investing in your 50s can produce impressive results with aggressive contributions.

The reality check: starting in your 50s requires not just following the 15 percent rule but actively maximizing every available contribution method and possibly working a few years past traditional retirement age to let investments continue growing.

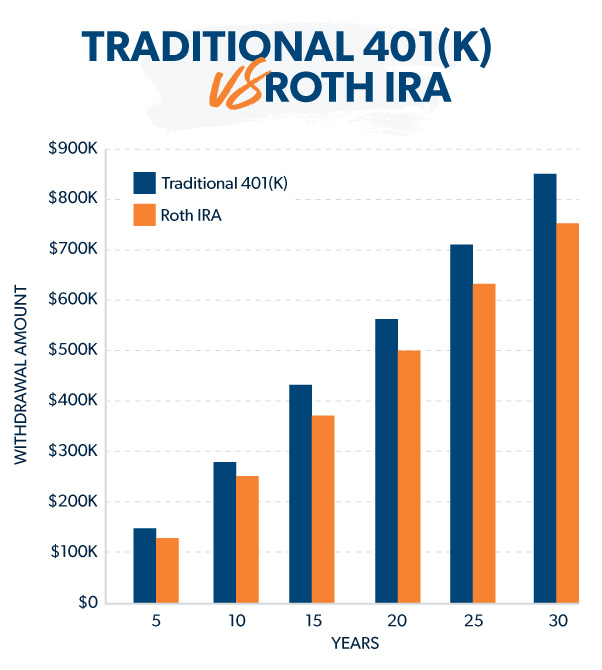

Traditional 401K vs Roth 401K Calculator Considerations

What Dave Ramsey Says About Roth Options

Dave Ramsey has a strong preference for Roth 401k options when available in your employer’s plan. His reasoning centers on tax-free growth and withdrawals. With a Roth 401k, you pay taxes on your contributions now (they come from after-tax income), but all growth and withdrawals in retirement are completely tax-free.

Ramsey argues that taxes will likely be higher in the future, making it wise to pay them now at potentially lower rates. Additionally, having tax-free income in retirement gives you more control over your tax situation and allows your retirement dollars to stretch further.

However, he acknowledges that traditional 401k contributions make sense for some high earners currently in very high tax brackets who expect to be in lower brackets during retirement. The tax deduction on traditional contributions provides immediate tax relief that can be substantial for those in the highest brackets.

Most importantly, Ramsey emphasizes that the Roth versus traditional decision shouldn’t paralyze you into inaction. Either option is infinitely better than not investing at all.

How Each Option Affects Your Calculator Results

When using a Dave Ramsey 401k calculator, understanding the difference between traditional and Roth impacts how you interpret your results. If you’re contributing to a traditional 401k, the calculator shows your pre-tax balance. You’ll owe ordinary income taxes on every dollar you withdraw in retirement.

A $1 million traditional 401k might only provide $700,000-$800,000 in actual spending power after federal and state taxes, depending on your retirement tax bracket. Meanwhile, a $1 million Roth 401k provides the full $1 million in tax-free spending power.

This creates an interesting planning consideration: to achieve the same after-tax retirement income, you need a larger traditional 401k balance than Roth 401k balance. Some sophisticated calculators allow you to specify your expected retirement tax rate to show after-tax projections, giving you a more realistic picture of your retirement purchasing power.

When calculating how to become a 401k millionaire Dave Ramsey style, consider whether you’re targeting a million-dollar pre-tax balance or after-tax spending power, as this significantly affects your required contribution levels.

Common Mistakes When Using 401K Calculators

Using Unrealistic Rate of Return Assumptions

One of the biggest errors people make when they calculate 401k growth is assuming 15% annual returns because they heard the market had a great year recently, or conversely using just 4% because they’re scared of another 2008-style crash. Both extremes produce misleading projections.

While Dave Ramsey retirement savings by age charts often reference 10-12% historical averages, these represent gross returns before accounting for inflation and fees. Using 12% in your monthly contribution calculator will likely show you reaching millionaire status years earlier than reality, potentially causing you to under-save.

Conversely, using ultra-conservative 4-5% returns might lead you to think retirement wealth is impossible, causing discouragement and reduced contributions. The reasonable middle ground for long-term stock mutual fund growth is 7-10%, with 8% being a sensible baseline for someone with decades until retirement.

Always run scenarios at multiple return rates—say 7%, 8%, and 9%—to see a range of outcomes. This gives you a realistic target while acknowledging that market returns are inherently uncertain.

Forgetting About Inflation

Even if your 401k reaches $1.5 million in 30 years, that won’t have the same purchasing power as $1.5 million today. Inflation steadily erodes the value of money over time. At a 3% average inflation rate, a dollar 30 years from now will only buy about what 41 cents buys today.

Most basic calculators show nominal returns (the actual account balance) rather than real returns (inflation-adjusted purchasing power). When projecting retirement savings growth, you need to mentally adjust for inflation or use a calculator that accounts for it automatically.

This is why some planners suggest you need $2 million or more to retire comfortably—by the time you reach retirement age, that $2 million might have the purchasing power of $1 million in today’s dollars. When asking “when can I become a 401k millionaire,” also ask “what will a million dollars buy when I get there?”

The practical approach is to contribute consistently while understanding that your target number should be thought of in terms of purchasing power, not just a fixed dollar amount.

Not Accounting for Fees

Investment fees—specifically expense ratios on mutual funds and administrative fees charged by your 401k plan—quietly drain your returns over decades. A fund charging 1.5% in annual fees versus one charging 0.5% might not seem dramatically different, but over 30 years, that 1% difference can cost you hundreds of thousands of dollars.

Dave Ramsey’s view on fund fees acknowledges they exist but emphasizes that actively managed funds earn their fees through superior performance. However, not all actively managed funds actually outperform their benchmarks after fees. When selecting investments within your 401k, review the expense ratios carefully.

Most Dave Ramsey investment growth calculator tools don’t automatically subtract fees from projected returns, meaning your actual results will be lower than calculated. If you’re assuming 8% returns but your funds charge 1.2% in combined fees, your real return is closer to 6.8%, which significantly impacts long-term growth.

Review your 401k statement for administrative fees and compare the expense ratios of available fund options. Even small fee reductions compound into substantial savings over time.

Ignoring Salary Growth

Most 401k investment calculator tools assume you’ll contribute the same dollar amount every year until retirement. But most people earn more as they age, progress in their careers, and receive raises. If you’re contributing 15% of a growing income, your actual contribution dollars increase over time, dramatically accelerating your path to millionaire status.

Someone earning $60,000 at age 30 might earn $90,000 by age 45 and $110,000 by age 55 as they gain experience and advance. If they maintain the 15 percent rule throughout, their contributions grow proportionally, pumping significantly more money into their retirement account in later years.

The Ramsey 401k contribution calculator 2026 should ideally allow you to input expected salary growth—even a modest 2-3% annual increase makes a substantial difference over decades. If your calculator doesn’t have this feature, manually recalculate every few years as your income grows to see your updated timeline.

A powerful strategy is committing to increase your 401k contribution percentage with every raise, turning salary growth directly into accelerated retirement wealth building.

Dave Ramsey’s Millionaire Research and What It Means for You

The National Study of Millionaires Findings

Ramsey Solutions conducted extensive research published as “The National Study of Millionaires,” surveying over 10,000 American millionaires to understand how they built wealth. The findings powerfully support Ramsey’s investment philosophy and prove that becoming a millionaire is achievable for ordinary people.

The study revealed that 8 out of 10 millionaires invested in their employer-sponsored 401k plan, making it the most common wealth-building tool among the millionaire population. This wasn’t by accident—it was the result of consistent, long-term investing in tax-advantaged retirement accounts with employer match.

The average time these individuals took to reach millionaire status was 28 years of consistent investing. They didn’t get there through lottery wins, inheritances, or risky cryptocurrency speculation. They reached millionaire status through boring, consistent, monthly contributions to retirement accounts holding growth stock mutual funds.

Perhaps most importantly, the study found that millionaire status correlated more strongly with consistent investing behavior than with income level. High earners who spent everything never became millionaires, while moderate earners who invested consistently did.

How Ordinary People Become 401K Millionaires

The average millionaire in Ramsey’s study had an average household income of $200,000—comfortable but not extraordinary, especially when you consider this was their income after years of career advancement. Many started with far more modest salaries and built wealth through discipline and time.

One-third of millionaires in the study never had a six-figure household income in any single year. They became millionaires purely through consistent saving and investing over long periods, letting compound interest do the heavy lifting. This destroys the myth that you need an enormous salary to build seven-figure wealth.

The behavior-over-salary emphasis in Ramsey’s millionaire research provides hope and clear direction: focus on what you can control (your savings rate, investment consistency, staying debt-free) rather than obsessing over things you can’t control (market returns, starting salary, economic conditions).

The data shows that ordinary people with ordinary jobs become 401k millionaires by following a simple formula: invest 15% of income consistently, stay invested through market downturns, maintain diversification, and give it enough time to work. No secret strategy needed.

Beyond the Calculator: Action Steps to Reach Your Goal

How to Increase Your 401K Contributions Today

Knowing your target is valuable, but only action produces results. Increasing your 401k contributions today is simpler than most people think. Log into your employer’s benefits portal or contact HR to adjust your payroll deductions. Most systems allow you to specify either a percentage of income or a fixed dollar amount per paycheck.

If you’re currently contributing 3% and need to reach 15% for the Ramsey plan, the jump might feel overwhelming. Use an incremental increase strategy: bump it to 6% now, then increase by 2% every six months until you reach 15%. This gradual approach is less painful to your monthly budget and creates sustainable habit change.

Many employers now offer automatic annual increase features where your contribution percentage rises by 1-2% each year, usually timed with annual raises. This “set it and forget it” approach is perfect for automating your wealth building—you never see the money, so you don’t miss it, and your retirement contributions grow steadily.

If you receive bonuses, commission, or periodic windfalls, consider directing a portion or all of them to your 401k until you hit the annual maximum. This accelerates your progress without affecting your regular monthly budget.

Choosing the Right Investments Within Your 401K

Once money is flowing into your 401k, you must actually invest it in something—simply contributing doesn’t automatically invest the funds in many plans. Dave Ramsey’s four-fund approach recommends spreading money equally across four fund categories: growth (large-cap stocks), growth and income (large value stocks), aggressive growth (small-cap stocks), and international funds.

This creates diversification across company sizes, styles, and geographic regions, reducing risk while maintaining strong growth potential. Review your 401k plan’s investment menu and identify one fund in each category. Allocate 25% of contributions to each, creating a balanced, aggressive portfolio appropriate for long-term retirement investing.

Avoid single stocks within your 401k, even if it’s your own company’s stock. Ramsey warns against overconcentration in company stock—you’re already dependent on your employer for your paycheck, and adding dependence for your retirement creates excessive risk. If your company offers stock as part of compensation, sell it periodically and diversify into mutual funds.

Target-date funds might seem convenient, but Ramsey prefers you maintain control over asset allocation rather than letting an automated formula that becomes increasingly conservative as you age potentially limit your growth in the final high-earning years before retirement.

When to Seek Professional Guidance

While Dave Ramsey’s investment philosophy is straightforward, some people benefit from professional guidance when implementing it. The SmartVestor Pro program connects you with investment professionals who share Ramsey’s philosophy on debt-free investing and long-term growth.

The DIY versus professional help decision depends on your comfort level with financial concepts, time availability, and complexity of your situation. If you have a simple 401k with clear fund options and you understand the four-fund approach, you may not need an advisor. However, if you have multiple retirement accounts, complex employer plans, or simply want accountability and guidance, working with a professional makes sense.

What to look for in an advisor: someone who doesn’t earn commissions on the products they recommend (fee-only is ideal), has the heart of a teacher willing to explain their recommendations, supports your goal of becoming debt-free before aggressive investing, and understands growth-oriented long-term investing rather than excessive conservatism.

A quality advisor helps you create a comprehensive retirement strategy, review fund selections annually, rebalance when needed, and stay the course during market volatility when emotions might tempt you to make poor decisions.

Frequently Asked Questions About Dave Ramsey’s 401K Calculator Approach

How much should I put in my 401k according to Dave Ramsey?

Ramsey recommends investing 15% of your gross household income into retirement accounts once you’re debt-free except for your mortgage, always capturing full employer match.

What rate of return does Dave Ramsey use in his calculations?

He typically references 10-12% based on historical stock market averages, though 8-10% is more conservative for planning purposes considering fees and market variability.

Should I invest in my 401k before paying off debt?

Only contribute enough to get full employer match while in Baby Steps 1-3; delay the full 15% until Baby Step 4 after all consumer debt is eliminated.

Does Dave Ramsey recommend maxing out your 401k?

Not necessarily—he recommends 15% of income across all retirement accounts, which might not equal the IRS maximum, ensuring balance with other financial goals.

What is the Dave Ramsey investment calculator?

It’s a retirement projection tool that estimates future account balance based on current age, income, contributions, time horizon, and expected returns using Ramsey’s investment philosophy.

How long will it take to become a 401k millionaire?

Starting in your 20s or 30s with 15% contributions typically achieves millionaire status in 25-32 years; starting in your 40s requires 20-25 years with consistent investing.

Should I choose traditional or Roth 401k?

Ramsey prefers Roth 401k when available for tax-free growth and withdrawals, though traditional makes sense for those currently in very high tax brackets.

What does Dave Ramsey think about target-date funds?

He’s not a fan, preferring investors maintain control over asset allocation through actively managed mutual funds spread across four growth-oriented categories instead.

How do I factor in employer match in my calculations?

Include employer match as part of your total annual contribution when projecting growth; it accelerates your timeline significantly and represents guaranteed immediate returns.

What if I cannot afford to invest 15% right now?

Start with whatever percentage captures full employer match, then incrementally increase contributions annually, working toward the 15% target as your financial situation improves.

Conclusion

Becoming a 401k millionaire isn’t reserved for the wealthy—it’s achievable for anyone who consistently invests using Dave Ramsey’s proven principles. The 15 percent rule, combined with employer match and compound interest, creates a clear path to seven-figure retirement wealth.

Use a Dave Ramsey 401k calculator to project your personal timeline, understand 2026 contribution limits, and choose Roth options when available.

Start today, stay consistent through market volatility, and trust the process that’s worked for thousands of ordinary people who became millionaires through disciplined 401k investing.