Imagine this: your car breaks down, requiring $8,000 in repairs, but most of your money is tied up in investments you can’t quickly access. This scenario highlights why understanding investment liquidity matters just as much as potential returns.

Which Investment Has the Least Liquidity? Private equity, real estate properties, and venture capital investments represent the least liquid investment options available today, often requiring years before you can convert to cash.

This comprehensive guide reveals exactly Which Investment Has the Least Liquidity?, why liquidity matters for your financial flexibility, and how to balance liquid assets with illiquid investments for optimal portfolio performance in 2026.

Table of Contents

What Is Investment Liquidity? (Understanding the Basics)

Investment liquidity refers to how quickly and easily you can convert an asset to cash without significantly affecting its market value. Think of it as the difference between having a $20 bill in your wallet versus owning a rental property—one provides immediate access to funds, while the other requires weeks or months to liquidate positions.

Market liquidity determines your financial flexibility during emergencies, opportunities, or life changes. Highly liquid assets like public stocks can be sold within seconds during market hours, while illiquid investments like private company ownership might take years to exit investment positions.

The liquidity spectrum ranges from cash (100% liquid) to private equity funds (potentially 0% liquid for years). Between these extremes lie various asset classes with different time horizons and transaction costs. Large-cap stocks trading millions of shares daily offer high liquidity, while tangible assets like art and collectibles depend on finding the right buyer at the right price.

Understanding this spectrum helps you allocate capital based on when you’ll need access funds. A 25-year-old building retirement savings can afford more illiquid investments than a 60-year-old approaching retirement who needs immediate access to capital for living expenses and potential healthcare costs.

How Is Liquidity Measured?

Liquidity measurement involves multiple factors beyond just time to sell. Bid-ask spread—the difference between buying and selling prices—indicates how much value you lose in transactions. Narrow spreads (like $0.01 on major stocks) signal high liquidity, while wide spreads suggest difficulty finding buyers.

Market depth reveals how many buyers and sellers actively trade an asset. Cryptocurrencies on major exchanges demonstrate varying depth—Bitcoin trades with high volume, while obscure tokens may lack sufficient market demand to sell quickly without price discounts.

Transaction costs include broker fees, commissions, legal expenses, and taxes that reduce your net proceeds. Real estate investments typically incur 6-8% in selling costs, while stock trades might cost $0-$10, making stocks far more liquid from a cost perspective.

Time to convert to cash remains the most practical measure. Money market funds provide same-day access, mutual funds settle in 1-2 days, real estate properties take 30-90 days minimum, and limited partnerships might require 5-10 years before distribution of capital.

Valuation transparency also affects liquidity—assets with clear, observable prices (like public stocks with real-time quotes) trade more easily than assets requiring professional appraisals, such as private equity investments or unique collectibles.

Key Factors That Determine Investment Liquidity

Several interconnected factors create the liquidity profile of any investment vehicle. Market demand tops the list—assets that many investors want to buy naturally sell faster. Apple stock trades instantly because millions of investors recognize its value, while shares in a small private company struggle to find buyers.

- Availability of buyers depends on market infrastructure. Public stocks benefit from centralized exchanges connecting millions of traders worldwide. Secondary markets for private equity remain limited, forcing sellers to negotiate individually with qualified investors who meet strict accreditation requirements.

- Transaction costs and fees create friction that reduces effective liquidity. Selling a $500,000 rental property might cost $30,000-$40,000 in realtor commissions, legal fees, and closing costs—an 8% haircut that makes owners hesitant to sell quickly. Meanwhile, selling $500,000 in bonds might cost under $100.

- Legal and regulatory restrictions often prevent immediate sales. Lock-up periods in hedge funds and private equity funds legally prohibit withdrawals for specified terms, typically 1-10 years. These capital commitment requirements protect fund managers from forced asset sales but eliminate your financial flexibility.

- Time required to complete transactions varies dramatically. Stock trades execute in milliseconds electronically, while real estate transactions involve inspections, appraisals, title searches, financing approvals, and legal documentation—processes requiring 30-90 days even when buyers are readily available.

- Valuation transparency accelerates or impedes sales. Assets with clear, objective pricing mechanisms (stock exchanges, bond markets) trade efficiently. Assets requiring subjective valuations—like art and collectibles, privately-held businesses, or venture capital investments in startup companies—demand extensive due diligence that lengthens the selling process and reduces the pool of potential buyers.

Market conditions amplify or diminish these factors. During financial crises, even normally liquid assets can become illiquid as buyers disappear and bid-ask spreads widen dramatically, demonstrating that liquidity exists on a continuum rather than as a fixed characteristic.

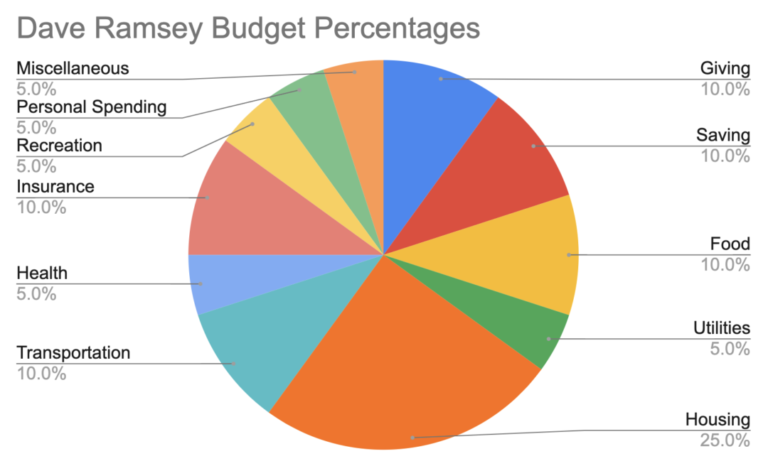

Read This: Dave Ramsey 401K Calculator: Plan for a Million $ (2026)

Which Investment Has the Least Liquidity? (Top 7 Illiquid Investments)

1. Private Equity Investments

Private equity represents one of the absolute least liquid investment vehicles available. These funds invest in non-public companies, either buying entire businesses or taking significant ownership stakes to restructure operations and eventually sell for profit.

The typical private equity fund requires a 5-10 year commitment with no option to withdraw capital early. Investors commit money that fund managers “call” over 3-5 years as they identify acquisition targets. Your capital gets deployed into buying companies, improving operations, and positioning them for sale through IPOs or strategic acquisitions.

Lock-up periods prevent redemptions entirely during the investment horizon. Unlike mutual funds where you can sell shares back to the fund daily, limited partnership structures in private equity legally bind your capital until the fund liquidates its holdings and makes distributions—a process typically taking 7-12 years from initial investment.

The secondary market for private equity interests remains extremely limited. Specialized firms buy limited partnership stakes at significant discounts (often 20-40% below net asset value) from investors desperate for liquidity, but these transactions require extensive legal work and the fund manager’s approval.

Example: You invest $100,000 in a private equity fund in 2026. The fund calls your capital in installments through 2029, invests in five companies, improves their operations through 2030-2033, then sells them between 2034-2036. You receive distributions as sales occur, potentially getting your last distribution in 2036-2038—a 10-12 year time to convert to cash.

2. Real Estate Properties

Real estate investments rank among the least liquid assets due to extended selling processes, high transaction costs, and market dependency. Unlike stocks that trade instantly, real estate properties require finding qualified buyers, negotiating terms, completing inspections, securing financing, and closing legal transfers.

- Residential properties typically require 30-60 days to sell in balanced markets, though this timeline extends to 90-180 days during downturns when market demand weakens. Commercial properties often take 6-12 months due to smaller buyer pools, complex valuations, and larger capital requirements.

- Transaction costs of 6-10% significantly impact liquidity. Selling a $400,000 home costs roughly $24,000-$32,000 in realtor commissions (typically 6%), plus title insurance, legal fees, repairs, and potential concessions to buyers. These costs make quick sales economically painful.

- Property location dramatically affects selling speed. Homes in desirable urban areas with strong job markets sell faster than rural properties with limited buyer interest. A condo in Manhattan might sell in weeks, while farmland in remote areas could take years to find buyers.

Market conditions create additional liquidity challenges. During the 2008 financial crisis, real estate investments became nearly impossible to sell at reasonable prices as buyers disappeared and financing evaporated. Even in normal times, seasonal variations affect selling speed—spring typically sees more transactions than winter.

Example: You own a $350,000 rental property and need cash urgently. Listing takes 1-2 weeks, showings occur over 3-4 weeks, negotiations take another week, and closing requires 30-45 days. Total timeline: 10-14 weeks minimum, assuming you accept the first reasonable offer. Rejecting low offers extends this considerably.

3. Venture Capital Funds

Venture capital investments in early-stage startup companies represent extremely illiquid positions with uncertain exit strategies and extended holding periods of 7-10 years. These funds invest in companies too young for traditional private equity, providing capital for product development, market expansion, and growth.

The long-term commitment stems from startup growth cycles. Early-stage companies need 5-7 years to develop products, acquire customers, prove business models, and reach sufficient scale for acquisition or IPO. Venture funds therefore structure as 10-12 year partnerships with no early redemption options.

Exit events—the only way to convert to cash—depend entirely on portfolio companies’ success. If startups fail (a common outcome), that capital is lost entirely. If they succeed, exits occur through initial public offerings or acquisitions by larger companies, events the fund cannot control or predict.

Higher risk accompanies venture capital’s illiquidity, but successful investments can generate returns of 10x-100x initial capital. However, the majority of venture investments return zero or minimal proceeds, making this asset class suitable only for investors who can afford to lose their entire capital commitment.

Capital calls further reduce financial flexibility. You commit $500,000 to a venture fund, but the fund might call only $100,000 in year one, $150,000 in year two, and $250,000 in year three. You must keep the uncalled capital readily available, reducing your ability to deploy it elsewhere while waiting for calls.

Private Equity vs Venture Capital: Which Is Less Liquid?

Both rank among the absolute least liquid investments, but subtle differences exist. Venture capital typically requires longer holding periods (10-12 years vs. 7-10 years for private equity) due to earlier-stage investments. However, private equity’s larger average check sizes ($10M+ vs. $1M-5M for venture) make secondary sales even more challenging to arrange. Both offer essentially zero liquidity during holding periods, with private equity having slightly more developed secondary markets for distressed sellers, though still at substantial discounts to net asset value.

4. Private Company Ownership

Direct ownership stakes in privately-held businesses represent perhaps the single least liquid investment. Unlike private equity funds that eventually liquidate holdings, direct private company ownership continues indefinitely unless you actively arrange a sale or exit.

Finding buyers presents the primary challenge. Private company shares lack centralized marketplaces connecting buyers and sellers. You must independently identify potential acquirers—often competitors, employees, or other investors familiar with the industry—then negotiate terms without market-based pricing references.

Regulatory restrictions frequently limit who can purchase shares. Many private companies have shareholder agreements granting existing owners “right of first refusal” on any sale, or restricting sales to accredited investors only. These provisions protect remaining shareholders but severely limit your buyer pool.

Valuation difficulties complicate negotiations. Without public market prices, determining fair value requires hiring professional appraisers who analyze financial statements, compare industry multiples, and project future cash flows—expensive, time-consuming processes that discourage casual buyers.

Family business ownership illustrates these challenges perfectly. Inheriting a 25% stake in a family manufacturing business provides income through distributions but offers no exit unless other family members want to buy your shares or the entire business sells to an outsider—events that might never occur.

Example: You own 15% of a successful private software company worth approximately $20 million (your stake: $3 million). Selling requires finding a buyer willing to pay $3 million for a minority stake with no control rights, convincing existing shareholders to approve the transfer, completing legal due diligence, and negotiating purchase terms. This process might take 12-24 months even in ideal conditions.

5. Art, Antiques, and Collectibles

Art and collectibles combine illiquidity with extreme valuation subjectivity. Unlike financial assets with observable prices, fine art, rare antiques, vintage cars, and collectible items depend on finding buyers who appreciate specific pieces and agree on subjective valuations.

- Niche markets limit buyer pools dramatically. A rare 18th-century French armoire might be worth $50,000 to serious collectors but have essentially zero value to typical homeowners. Finding those specific collectors requires specialized auction houses, dealers, or private networks—processes taking months or years.

- Authentication needs add complexity and cost. Potential buyers rightfully demand proof of authenticity, requiring expert verification, provenance documentation, and sometimes scientific testing. These processes cost thousands of dollars and extend transaction timelines significantly.

- Market trend dependency creates additional uncertainty. Collectibles experience boom-bust cycles as tastes change. Mid-century modern furniture skyrocketed in value during the 2010s but has cooled recently. Baseball cards exploded during the pandemic then declined. These trends are unpredictable and can leave you holding assets that suddenly have no buyers at any price.

Transaction costs often reach 20-30% for auction sales when combining seller’s premiums, buyer’s premiums, insurance, shipping, and marketing costs. Selling privately reduces fees but requires more time and effort finding qualified buyers.

Example: You own a painting by a mid-level contemporary artist purchased for $25,000. To sell, you consult galleries who estimate current market value at $20,000-$30,000. You consign it to an auction house paying 15% seller’s premium. The auction occurs in 3 months, but the painting doesn’t meet its reserve price and doesn’t sell. You try private sales through art dealers, finally selling 8 months later for $23,000 minus $3,500 in commissions—total timeline: 11 months, 14% loss.

6. Hedge Funds

Hedge funds occupy a middle ground between liquid mutual funds and completely illiquid private equity, but their restrictions still classify them among less liquid investment vehicles. These actively-managed funds use diverse strategies including short-selling, derivatives, leverage, and alternative assets to generate returns uncorrelated with traditional markets.

- Lock-up periods of 1-3 years prevent any withdrawals after initial investment. This protects fund managers from having to sell positions at inopportune times to meet redemptions, but completely eliminates your access to capital during this term.

- Redemption windows limit withdrawals to specific dates even after lock-ups expire. Many hedge funds only allow quarterly redemptions with 30-90 days advance notice. Some restrict redemptions to annually, and most reserve the right to “gate” redemptions (limit total withdrawals) during market stress.

- Redemption fees of 2-5% penalize early withdrawals even during allowed windows. Combined with standard 2% annual management fees and 20% performance fees, these costs can severely impact net returns if you need to exit investment positions earlier than planned.

Minimum investment requirements of $100,000-$1,000,000+ and accredited investor restrictions further limit liquidity by reducing potential buyers if you try to sell your position privately. Secondary markets for hedge fund interests barely exist outside specialized firms.

Example: You invest $500,000 in a hedge fund with a 2-year lock-up and quarterly redemptions thereafter. After 18 months, you need the capital, but you’re legally unable to withdraw. At month 24, you submit a redemption notice, but the fund only processes redemptions quarterly with 60-day notice. You actually receive your funds at month 27, paying a 3% early redemption fee ($15,000), getting back $485,000 before considering any investment gains or losses.

7. Certain Certificates of Deposit (CDs)

While generally considered safe, conservative investments, long-term certificates of deposit can be surprisingly illiquid due to early withdrawal penalties and fixed maturity dates. CDs represent time deposits at banks where you lock funds for specified periods at guaranteed interest rates.

- Long-term CDs ranging from 3-10 years offer higher interest rates but impose substantial penalties for early access to funds. These penalties typically equal 3-12 months of interest, potentially eliminating all gains and even eating into principal if withdrawal occurs early in the term.

- Fixed maturity dates provide no flexibility for changing financial needs. If you purchase a 5-year CD paying 4.5% but need the money after 2 years for an unexpected expense, you’ll pay penalties that might reduce your effective return to 1-2%—far below what you’d have earned in more liquid money market funds.

Bank-specific restrictions vary significantly. Some institutions allow penalty-free withdrawals in specific circumstances (account owner death, disability), while others impose strict penalties regardless of circumstances. Shopping for favorable early withdrawal terms is essential before committing to long-term CDs.

Unlike stocks or bonds that can be sold to other investors, CDs can only be redeemed with the issuing bank, eliminating secondary market options entirely. You’re completely dependent on the bank’s terms for any early access.

Example: You purchase a $50,000, 5-year CD paying 4.5% annual interest ($2,250/year). After 2 years, a medical emergency requires cash. The early withdrawal penalty equals 12 months of interest ($2,250), eliminating one year’s gains. You receive approximately $52,250 instead of the $54,500 you’d earned by that point—effectively earning just 2.25% annually, less than you’d have received in a high-yield savings account with complete liquidity.

The Liquidity Spectrum: From Most to Least Liquid Investments (2026)

Understanding where different asset classes fall on the investment liquidity spectrum helps you build balanced portfolios matching your time horizon and cash flow needs. This framework organizes investments from immediate access to potentially decade-long commitments.

Most Liquid:

- Cash and cash equivalents – Instant access, no conversion needed, perfect liquidity but lowest returns due to inflation erosion.

- Money market funds – Same-day or next-day access to funds, minimal transaction costs, stable $1 net asset value, yields currently 4-5%.

- Large-cap stocks – Stocks of major companies like Apple, Microsoft, or ExxonMobil trade instantly during market hours with narrow bid-ask spreads of $0.01-0.05 on millions of shares daily. Settlement occurs in 2 business days.

- Government bonds – U.S. Treasury bonds trade in deep, liquid markets with transparent pricing and minimal spreads. You can sell millions in Treasuries within seconds during market hours.

- Corporate bonds – Investment-grade corporate bonds from well-known issuers (Apple, Johnson & Johnson, JPMorgan) trade reasonably efficiently, though with wider spreads than Treasuries and settlement in 2-3 days.

Moderately Liquid:

- Small-cap stocks – Shares of smaller public companies trade less frequently with wider spreads, potentially taking hours or days to sell large positions without moving prices.

- Mutual funds – Redeem at end-of-day net asset value, settle in 1-3 business days. Very liquid for most purposes but can’t exit intraday during market crashes.

- ETFs (Exchange-Traded Funds) – Trade like stocks during market hours but underlying assets might be less liquid (emerging market bonds, commodities), potentially creating premiums/discounts to net asset value during stress.

- REITs (Real Estate Investment Trusts) – Publicly-traded REITs offer daily liquidity despite owning illiquid real estate properties, though prices can be volatile and spreads widen during market uncertainty.

Least Liquid:

- Private equity – 5-10 year lock-ups, no secondary market except at steep discounts, capital calls require holding additional cash reserves.

- Real estate properties – 30-180 days to sell, 6-10% transaction costs, highly dependent on local market conditions and buyer financing availability.

- Venture capital – 7-12 year commitments, outcomes depend entirely on portfolio company exits through IPO or acquisition, high failure rates.

- Art and collectibles – Highly subjective valuations, niche buyer pools, authentication requirements, 20-30% transaction costs through auctions.

- Private company ownership – No public market, limited buyers, complex negotiations, regulatory restrictions on sales, potentially infinite holding periods.

Each step down this spectrum generally correlates with higher expected returns—the illiquidity premium compensating investors for reduced financial flexibility. However, these higher returns aren’t guaranteed and come with substantially higher risks of permanent capital loss.

Time to liquidate ranges from instant (cash) to seconds (large-cap stocks) to days (bonds, mutual funds) to weeks (small-cap stocks) to months (real estate properties) to years or decades (private equity, venture capital). Building an investment portfolio requires matching these timelines with when you’ll need access funds for goals like emergency expenses, down payments, education costs, or retirement income.

Why Are Some Investments Less Liquid?

Structural and Legal Barriers

Partnership agreements in private equity funds and venture capital investments explicitly prohibit early withdrawals, protecting fund managers’ ability to execute long-term investment strategies without forced sales. These legal structures benefit remaining investors but completely eliminate your liquidity.

- Regulatory restrictions limit who can purchase certain investments. Accredited investor requirements—net worth exceeding $1 million or income above $200,000 annually—reduce potential buyers for hedge funds, private placements, and venture capital interests by roughly 90% of the population.

- Holding requirements in some investments mandate minimum ownership periods. Many employee stock plans impose vesting schedules and holding periods before shares can be sold. Some dividend reinvestment plans have similar restrictions.

Transfer restrictions in private company shareholder agreements require board approval for sales, grant existing shareholders right of first refusal, or completely prohibit transfers to outsiders. These clauses protect company stability but destroy marketability of ownership stakes.

Market-Related Factors

- Limited buyer pools naturally reduce liquidity. While millions of investors might purchase Apple stock, perhaps only dozens worldwide would consider buying a significant stake in a regional manufacturing company or a rare 17th-century violin.

- Infrequent trading characterizes many alternative investments. Real estate properties in specific neighborhoods might have only 2-3 transactions annually, providing minimal price discovery. Rare collectibles might sell once per decade, making current market value highly uncertain.

- Valuation challenges arise when assets lack standardized pricing mechanisms. Public stocks have real-time quotes based on continuous transactions, but valuing private companies requires extensive financial analysis, industry comparisons, and future projections—subjective processes that reasonable experts might disagree on by 30-50%.

Market infrastructure gaps prevent efficient trading of many assets. The New York Stock Exchange facilitates billions in daily transactions seamlessly, but no comparable platform exists for trading private company shares, creating bilateral negotiations with high search costs to find counterparties.

Economic and Timing Factors

- Market downturns disproportionately impact less liquid assets. During the 2008 financial crisis, real estate properties became nearly unsellable as buyers disappeared and financing evaporated, while stock markets, though declining severely, maintained functioning trading mechanisms.

- Seasonal variations affect many assets. Real estate transactions peak in spring/summer when families prefer moving, dropping 30-40% in winter. Art auctions concentrate around major shows and wealthy individuals’ tax planning calendars.

- Economic cycles create dramatic swings in demand for capital-intensive assets. Commercial real estate thrives during expansions when businesses need space, but vacancy rates spike during recessions. These cycles can extend 5-10 years, potentially forcing sales during unfavorable periods.

Industry-specific challenges add another layer. Technology startup valuations depend on venture capital availability, which fluctuates with interest rates and market sentiment. When venture funding contracts (as in 2022-2023), even successful startups struggle to raise money, delaying or preventing exit events that would return capital to earlier investors.

Risks of Investing in Low-Liquidity Assets

- Capital Lock-In Risk represents the primary danger of illiquid investments. Your money becomes unavailable for years or decades, potentially missing other opportunities or leaving you unable to handle emergencies. If you invest $200,000 in a private equity fund with an 8-year term and experience a job loss in year three, you cannot access that capital regardless of your financial distress.

- Valuation Uncertainty plagues assets without active markets. Your private equity fund might report your shares are worth $250,000 based on accounting estimates, but actual sale value could be $180,000 or $300,000—you won’t know until attempting to sell. This uncertainty complicates financial planning and net worth calculations.

- Forced Sale Risk creates devastating losses. When emergencies require immediate cash and all liquid assets are exhausted, selling illiquid investments under duress typically means accepting 20-40% discounts to estimated value. Private equity secondary buyers exploit desperate sellers, and real estate sold urgently often goes 10-15% below market value.

- Limited Exit Options reduce negotiating power. When selling liquid stocks, you access millions of potential buyers and receive competitive market prices. When selling a private company stake, perhaps 3-5 potential buyers exist, each knowing you have few alternatives, incentivizing low-ball offers.

- Market Timing Risk matters enormously for illiquid investments. You might invest in real estate near a market peak and need to sell during a downturn, locking in losses. With liquid investments, you could choose to wait for recovery, but inflexible time horizons in illiquid assets might force disadvantageous exits.

- Opportunity Cost accumulates when capital sits locked in underperforming illiquid investments. If your private equity fund returns 5% annually over 10 years while the stock market returns 10%, you’ve foregone substantial wealth accumulation—$100,000 at 5% grows to $163,000 versus $259,000 at 10%, a $96,000 difference you cannot recover.

- Concentration Risk intensifies because most illiquid investments require substantial minimum commitments. While you might spread $100,000 across 50 different stocks, that same $100,000 might only access 1-2 private equity funds, dramatically reducing portfolio diversification and increasing exposure to manager skill and specific industry risks.

These risks don’t make illiquid investments inappropriate—they simply demand careful consideration of whether you can genuinely afford to lock capital away for extended periods and whether potential returns justify the risks and lost flexibility.

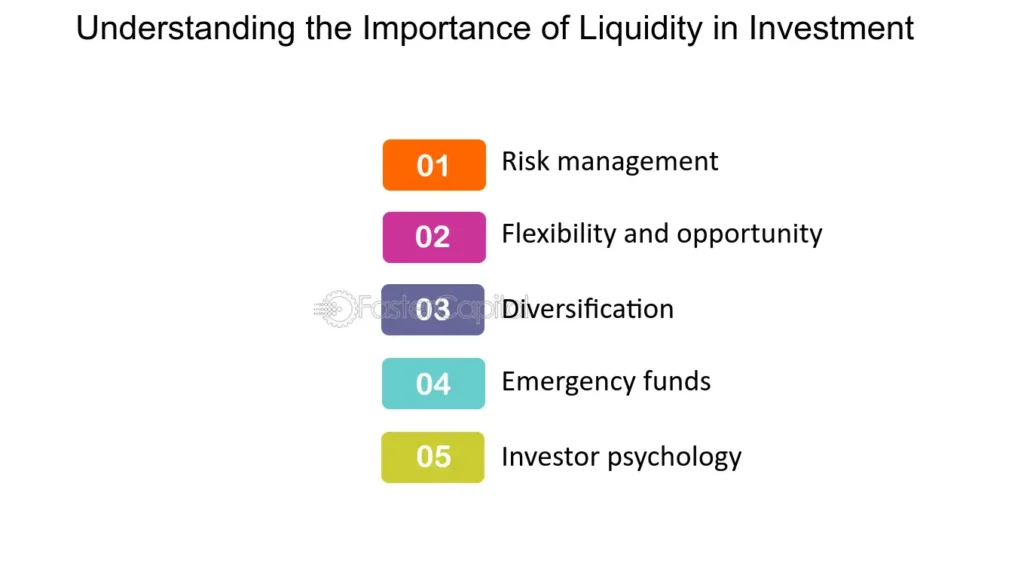

Benefits of Illiquid Investments (Why Investors Still Choose Them)

Higher Return Potential provides the primary attraction to illiquid investments. Historical data shows private equity returning 10-14% annually versus 9-10% for public stocks, while venture capital funds occasionally generate returns of 20-30%+ annually during favorable periods. This illiquidity premium of 3-5% annually compensates investors for reduced financial flexibility.

Real estate investments similarly outperformed public stocks over many periods, especially when including rental income. From 2000-2020, direct real estate ownership in many markets returned 8-12% annually versus 6-7% for the S&P 500, while providing tax advantages and inflation protection.

Reduced Market Volatility Impact benefits long-term investors psychologically and financially. Illiquid investments don’t show daily price fluctuations on your brokerage statement. During the March 2020 COVID crash, stock investors watched portfolio values plummet 35% in weeks, triggering panic selling. Real estate and private equity investors saw no daily marks and couldn’t panic sell, preventing emotionally-driven mistakes.

This forced long-term focus aligns with Warren Buffett’s famous advice that his favorite holding period is “forever.” Illiquidity operationally enforces patient investing, preventing the destructive pattern of buying high during market euphoria and selling low during panics.

Portfolio Diversification improves through low correlation with public markets. Private equity and venture capital investments depend on company-specific execution rather than daily market sentiment. During stock market corrections driven by interest rate fears, your private company holdings continue growing revenue and profits regardless of public market anxiety.

Real estate investments correlate partially with economic cycles but respond to local supply/demand dynamics, construction costs, and zoning regulations—factors unrelated to whether the S&P 500 rises or falls today. This diversification genuinely reduces overall portfolio risk when combined appropriately with liquid assets.

Tax Advantages significantly enhance after-tax returns. Real estate investors enjoy depreciation deductions that shelter rental income from taxes, potentially creating tax losses on profitable properties. When eventually selling, 1031 exchanges allow deferring capital gains indefinitely by rolling proceeds into new properties.

Private equity and venture capital investments held over one year qualify for long-term capital gains rates (currently 15-20%) versus ordinary income rates reaching 37%. Qualified Opportunity Zone investments can defer and reduce capital gains while providing tax-free appreciation on new investments held 10+ years.

Access to Unique Opportunities represents the final major benefit. Some of the highest-quality investments never reach public markets. Top venture capital funds invest in companies during their highest-growth phases, often achieving 5-10x returns before IPOs. By the time these companies go public, much of the growth has already occurred.

Private equity funds buy entire companies, make operational improvements, add acquisitions, and optimize capital structures—value creation strategies impossible for public stock investors who can only buy existing shares. This active ownership generates returns unavailable through passive stock ownership.

These substantial benefits explain why sophisticated investors including university endowments, pension funds, and family offices allocate 20-40% of portfolios to illiquid investments despite the risks and lost flexibility. The key is ensuring you can afford the extended holding periods and have sufficient liquid reserves for unexpected needs.

How Much Liquidity Do You Need in Your Investment Portfolio?

Factors to Consider

- Emergency fund requirements form the foundation of liquidity planning. Financial advisors universally recommend maintaining 3-6 months of living expenses in completely liquid accounts—savings, money market funds, or short-term government bonds. This protects against job loss, medical emergencies, or major home/car repairs without forced investment sales.

- Age and life stage dramatically affect appropriate liquidity. Young professionals in their 20s-30s with stable employment, good health insurance, and decades before retirement can maintain lower liquidity reserves and allocate more to illiquid investments seeking higher returns. Retirees depending on investment income need substantially higher liquidity for living expenses.

- Income stability matters enormously. Tenured professors, government employees, or professionals with recession-resistant careers can accept less liquidity than commissioned salespeople, small business owners, or workers in cyclical industries facing unpredictable income fluctuations.

- Risk tolerance extends beyond market volatility to liquidity preferences. Some investors sleep better knowing they can access most assets within days, while others comfortably lock up capital for decades if returns justify it. Neither approach is wrong—understanding your personal psychology prevents stress-driven poor decisions.

- Short-term goals vs long-term goals require different liquidity approaches. Saving for a home down payment in 2-3 years demands high liquidity in savings accounts or short-term bonds. Retirement planning 30 years away allows substantial illiquid allocations seeking maximum growth.

- Family situation influences liquidity needs significantly. Parents with young children face higher unexpected expenses (braces, sports, college applications) requiring more liquid reserves. Dual-income households with both partners employed full-time need less liquidity than single-income families where job loss eliminates all income.

The 80/20 Rule for Liquidity

A practical guideline suggests maintaining 80% of investment assets accessible within 30 days for most investors in their working years. This ensures you can handle emergencies, capitalize on opportunities, or adjust portfolios as life circumstances change.

The remaining 20% can be invested in illiquid assets like real estate, private equity, or venture capital, seeking higher returns through the illiquidity premium. This allocation provides growth potential while maintaining overall portfolio flexibility.

However, this rule requires adjustment based on individual circumstances. Ultra-high-net-worth investors with $10+ million might comfortably allocate 40-50% to illiquid investments since 50% of $10 million ($5 million) still provides enormous liquidity for any conceivable need. Meanwhile, someone with $100,000 total investments might need 90% liquidity, as 10% ($10,000) in illiquid assets barely moves the needle on returns while potentially creating cash flow problems.

Liquidity Needs by Life Stage

Young Professionals (20s-30s): These investors have the longest time horizons and greatest ability to recover from setbacks, allowing higher illiquid allocation. A reasonable approach: 60-70% liquid, 30-40% illiquid. The liquid portion should include emergency funds plus diversified stock and bond investments. Illiquid allocations might include real estate (primary residence or rental property), potentially small private equity or venture capital investments if income and net worth permit.

Career growth in these decades typically increases income steadily, reducing reliance on investment withdrawals. Health issues remain relatively rare, and family obligations (elderly parents, children) often haven’t fully materialized, providing flexibility to ride out illiquid investment timelines.

Mid-Career (40s-50s): These investors balance competing priorities—accumulating retirement assets while potentially funding children’s education and caring for aging parents. Peak earning years provide income cushion but expenses also typically peak. Recommended allocation: 70-80% liquid, 20-30% illiquid.

The liquid portion should include substantial retirement savings in tax-advantaged accounts (401(k)s, IRAs) invested in stocks and bonds, plus emergency reserves and education savings in 529 plans. Illiquid allocations might include home equity, rental properties, or private equity positions if net worth justifies alternative investments.

This stage requires careful planning around major expenditures (college tuition starting in 5-10 years) that demand shifting toward more liquid, conservative investments as payment dates approach.

Pre-Retirement (50s-60s): These investors shift focus from accumulation to preservation, requiring increased liquidity. Within 5-10 years of retirement, ability to recover from major investment losses or illiquidity problems diminishes substantially. Recommended allocation: 80-85% liquid, 15-20% illiquid.

The liquid portion should gradually shift from stocks toward bonds and income-producing assets, ensuring sufficient cash flow for retirement without forced sales during market downturns. Illiquid allocations should be limited to investments expected to mature or provide exits before retirement—avoid new 10-year private equity commitments at age 60.

This transition requires active planning, potentially including selling real estate properties or private company interests while markets remain favorable, rather than hoping to sell after retirement when you’ll have less negotiating flexibility.

Retirement (65+): Retirees require maximum liquidity for living expenses, healthcare costs, and legacy planning. Recommended allocation: 90-95% liquid, 5-10% illiquid.

The liquid portion should emphasize income-generating assets (dividend stocks, bonds, REITs) that can be sold systematically to fund living expenses without depleting principal too quickly. A typical retiree might maintain 1-2 years of expenses in cash/money markets, 3-5 years in bonds, and longer-term needs in diversified stock portfolios.

Very limited illiquid allocations might include a vacation home or small private business interest, but only if sufficient liquid assets exist to comfortably fund all retirement needs. The risk of needing to sell illiquid assets urgently to cover medical emergencies or long-term care becomes too high to justify significant illiquid allocations.

These guidelines aren’t rigid rules but frameworks for thinking about appropriate liquidity levels as life circumstances evolve. Regular reviews and adjustments ensure your asset allocation continues matching your financial situation and goals.

How to Balance Liquid and Illiquid Investments in 2026

1. Assess Your Liquidity Needs First

Before allocating a single dollar to illiquid investments, calculate your total liquidity requirements precisely. Monthly expenses multiplied by 6-12 months establishes your emergency fund target, which should remain in completely liquid savings accounts or money market funds.

Identify upcoming major expenses within the next 5 years—home down payment, vehicle purchase, wedding costs, college tuition. These funds should stay in liquid investments with minimal risk like short-term bonds or CDs matching your timeline.

Build your emergency fund to 3-6 months for dual-income households with stable employment, 6-12 months for single-income families, small business owners, or those in volatile industries. Only after establishing this foundation should you consider illiquid investments.

2. Create a Tiered Liquidity Strategy

Structure your portfolio in layers matching different time horizons and purposes:

- Tier 1 (Immediate Access): Savings accounts and money market funds for emergency expenses and monthly bills. Target: 3-6 months living expenses.

- Tier 2 (Quick Access): Stocks, bonds, ETFs, and mutual funds for opportunities, large purchases, or income supplementation. Settlement in 1-3 days allows rapid access without penalties. Target: 1-3 years of additional expenses.

- Tier 3 (Medium-Term): Longer-term bonds, balanced funds, and potentially publicly-traded REITs for goals 3-10 years away. These investments trade efficiently but might require selling during temporary market downturns. Target: Based on specific goals (college, down payment).

- Tier 4 (Long-Term): Real estate properties, private equity, venture capital, or other illiquid investments for maximum growth over 7+ years. Target: Maximum 20-30% of total portfolio for most investors.

This structure ensures money you might need urgently stays accessible while allowing patient capital to seek higher returns through illiquid investments.

3. Don’t Over-Allocate to Illiquid Assets

The single biggest mistake investors make is committing too much capital to illiquid investments, discovering too late they need access to those funds. Conservative guidelines suggest maximum 20-30% of total investment portfolio in illiquid assets for most investors.

Higher allocations for ultra-high-net-worth individuals make sense—someone with $50 million might allocate 50% ($25 million) to illiquid investments while maintaining $25 million in liquid assets, still providing more liquidity than most people’s entire net worth.

Never exceed what you can afford to lock away means performing stress tests: “If I lost my job tomorrow and this investment became worthless, would I still have enough liquid assets to maintain my lifestyle for 12+ months?” If the answer is no, you’ve over-allocated.

Consider opportunity costs carefully. Private equity requiring $100,000 minimum investment might not make sense if your total portfolio is $300,000—that’s one-third of your wealth locked up for a decade, severely limiting financial flexibility.

4. Review and Rebalance Regularly

Annual liquidity checks should assess whether your circumstances have changed. New baby, aging parents, job change, health issues, or approaching retirement all demand liquidity reassessment and potential portfolio adjustments.

Life change triggers should prompt immediate review: marriage/divorce, inheritance, job loss/promotion, health crisis, or major purchases. Each event shifts your risk tolerance and liquidity needs, potentially requiring rebalancing.

Market condition adjustments matter for illiquid allocations. During extended bull markets, private equity values soar, potentially causing illiquid investments to exceed target allocation percentages. Consider rebalancing by adding to liquid investments rather than making new illiquid commitments.

Document your target allocations in an investment policy statement specifying acceptable ranges (e.g., “illiquid investments: 15-25% of portfolio”) and triggers for rebalancing (e.g., “rebalance if illiquid allocation exceeds 30%”). This prevents emotional decision-making during market volatility or personal stress.

Real-World Scenarios: When Liquidity Matters Most

Scenario 1: Medical Emergency

Sarah, age 42, needs emergency surgery costing $35,000 after insurance. Her portfolio includes $60,000 in stocks/bonds (liquid), $25,000 in savings (liquid), and $200,000 in a private equity fund (locked up for 6 more years). She easily covers medical bills from liquid assets without touching illiquid investments or incurring debt.

Her colleague Michael faces identical medical bills but has $15,000 in savings and $270,000 in illiquid real estate and private equity investments. He’s forced to use credit cards at 18% interest while frantically trying to arrange a home equity loan, creating stress during medical recovery. Lesson: Emergency funds must stay completely liquid.

Scenario 2: Job Loss

David loses his $120,000/year job during industry restructuring. His portfolio: $180,000 in liquid stocks/bonds/savings (18 months expenses) and $90,000 in rental property equity (illiquid). He comfortably covers expenses for 14 months until finding new employment at $115,000, never touching illiquid assets.

His neighbor Jennifer, earning similar income, structured differently: $50,000 liquid savings (5 months expenses) and $220,000 in private equity (illiquid). After 6 months unemployment, she exhausts liquid assets and desperately tries selling her private equity position on secondary markets, receiving offers of just $140,000 (36% discount to stated value). She accepts, locking in devastating losses. Lesson: Income disruption demands substantial liquid reserves.

Scenario 3: Investment Opportunity

During March 2020 market crash, Tom identifies amazing opportunities—blue-chip stocks down 40% from February highs. His portfolio: $150,000 liquid ($40,000 cash, $110,000 stocks he’s willing to sell) and $100,000 illiquid (private equity). He deploys $35,000 buying high-quality stocks at depressed prices, generating 180% returns over the next 18 months.

His friend Rachel has identical net worth but different structure: $30,000 liquid and $220,000 illiquid. She watches the opportunity helplessly, unable to deploy meaningful capital. Lesson: Illiquidity creates costly opportunity costs during market dislocations.

Scenario 4: Real Estate Purchase

Emily and James find their dream home requiring a $100,000 down payment. Their portfolio: $130,000 liquid stocks/bonds/savings and $70,000 in a rental property (illiquid). They comfortably make the down payment from liquid assets while maintaining emergency reserves.

Another couple, Mark and Lisa, have similar net worth ($200,000) but nearly all tied up in illiquid investments (two rental properties). They miss the dream home because they can’t access the $100,000 down payment without selling a rental property—a process requiring 3-6 months. By the time they secure financing, the home is sold. Lesson: Major life purchases require advance liquidity planning.

These scenarios illustrate that liquidity matters most during life’s unpredictable moments—exactly when you can’t choose timing. Maintaining appropriate liquid reserves prevents financial catastrophes and enables capitalizing on opportunities.

Common Mistakes Investors Make with Illiquid Investments

1. Over-allocating to illiquid assets represents the most frequent error. Investors chase higher returns promised by private equity or real estate without honestly assessing how long they can afford to lock up capital. Calculate exactly what percentage of your portfolio you can truly commit for 7-10 years before investing, not after.

2. Not understanding lock-up periods leads to unpleasant surprises. Investors assume they can withdraw “if they really need to” and discover legal agreements explicitly prohibit any early withdrawals. Read partnership agreements thoroughly and confirm you’re comfortable with the maximum possible holding period before committing.

3. Ignoring liquidity in retirement planning creates serious problems. Retirees who’ve allocated 50%+ of portfolios to illiquid real estate or private equity discover they can’t generate sufficient cash flow for living expenses without selling assets at unfavorable times or prices. Required minimum distributions (RMDs) from retirement accounts further complicate matters—you owe taxes on RMDs regardless of whether you can actually access the underlying illiquid investments.

4. Panic selling illiquid assets at steep discounts during emergencies or market stress destroys wealth. Better alternatives include home equity lines of credit, portfolio margin loans against liquid securities, or even 401(k) loans—all preferable to selling illiquid investments at 30-40% discounts to net asset value.

5. Failing to plan for liquidity events means missing strategic windows to exit investments. Private equity funds offer distributions as they sell portfolio companies—reinvesting these distributions immediately into new illiquid investments maintains excessive illiquid allocation. Instead, allow distributions to flow into liquid accounts, rebalancing your overall portfolio.

Avoid these mistakes through advance planning, honest self-assessment of risk tolerance and time horizons, and maintaining discipline around maximum illiquid allocations regardless of how attractive specific opportunities appear.

Expert Tips for Managing Illiquid Investments in 2026

- Work with a Financial Advisor specializing in alternative investments before committing to illiquid assets. These professionals help assess whether specific investments match your financial situation, time horizon, and risk tolerance. They provide objective analysis counterbalancing the optimistic projections from fund managers seeking your capital.

- Understand All Terms Before Investing means reading complete partnership agreements, private placement memorandums, and subscription documents—often 100+ pages of legal language. Focus especially on sections covering redemptions, distributions, fees, conflicts of interest, and manager discretion. Don’t rely on verbal assurances or marketing materials; only written legal terms matter.

- Maintain Adequate Liquid Reserves of 6-12 months living expenses beyond your illiquid commitments. This buffer prevents forced sales during emergencies and provides peace of mind that unexpected expenses won’t create financial crises.

- Diversify Within Illiquid Assets across different types (real estate, private equity, venture capital), vintages (investment years), and managers. Don’t commit your entire illiquid allocation to a single 2026 vintage private equity fund—instead, stagger commitments over 2026-2029 across 3-4 different funds and strategies.

- Plan Your Exit Strategy Upfront before investing. Understand exactly how you’ll eventually convert investments back to cash—through fund liquidations, secondary sales, IPOs, acquisitions, or property sales. Know typical timelines and success rates for each exit path. Investments without clear exit mechanisms often become permanent capital commitments.

- Monitor Market Conditions affecting your illiquid holdings even though you can’t trade daily. Changes in interest rates, industry regulations, or competitive dynamics impact private company values and real estate prices. Stay informed to set realistic expectations and recognize when reported valuations might not reflect economic reality.

These practices don’t guarantee investment success but significantly reduce the likelihood of illiquidity-related disasters that destroy wealth and create unnecessary financial stress.

The Future of Liquidity: Trends to Watch in 2026 and Beyond

Tokenization of real estate and private equity using blockchain technology promises enhanced liquidity for traditionally illiquid assets. Companies now create digital tokens representing fractional ownership in commercial properties or private equity funds, potentially enabling trading on secondary markets with settlement in minutes rather than weeks.

Early platforms allow investors to buy $1,000-$10,000 stakes in specific properties rather than requiring $100,000+ minimums, democratizing access while improving liquidity. However, these markets remain nascent with limited trading volume—tokenization creates potential liquidity rather than guaranteed liquidity.

Interval funds and semi-liquid alternatives have gained SEC approval, offering structures between daily-liquidity mutual funds and completely illiquid private equity. These funds allow quarterly or monthly redemptions of limited percentages (typically 5% of fund assets), providing some liquidity while enabling managers to invest in less liquid strategies.

Major asset managers launched interval funds investing in private credit, real estate, and infrastructure—previously available only through completely illiquid limited partnerships. These vehicles suit investors wanting alternative investment exposure with more flexibility than traditional structures provide.

Technology improving liquidity extends beyond blockchain to encompass digital platforms connecting buyers and sellers of private assets. Secondary markets for private equity interests, previously requiring expensive intermediaries and months of negotiations, now operate through online platforms matching buyers and sellers more efficiently.

Improved data analytics and valuation models provide better price discovery for private assets, reducing one barrier to efficient trading. As these tools mature, spreads between bid and ask prices should narrow, encouraging more trading and enhancing practical liquidity.

Regulatory changes from the SEC potentially expand who can invest in private markets while also enhancing investor protections. Proposed rules might lower accredited investor thresholds or create new investor categories with access to certain alternative investments, expanding secondary market depth.

Conversely, regulations might impose new disclosure requirements, mandatory liquidity gates, or restrictions on marketing that affect how private funds operate. Staying informed about regulatory evolution helps investors anticipate changing liquidity dynamics in alternative investments.

These trends suggest illiquid investments may become modestly more liquid over the next decade, though they’ll likely remain substantially less liquid than public stocks and bonds. Technology and innovation address some liquidity challenges but can’t eliminate the fundamental reality that certain assets—direct ownership of businesses, real estate properties, early-stage startups—require time to build value and find buyers.

Frequently Asked Questions (FAQs)

Q1: Which investment has the absolute least liquidity?

Private company ownership and certain private equity funds represent the absolute least liquid investments, potentially requiring 10+ years before any liquidity event occurs, with no guaranteed exit mechanism.

Q2: Is real estate really less liquid than stocks?

Yes, real estate typically requires 30–90 days to sell with 6–10% transaction costs, while stocks sell in seconds with minimal transaction costs during market hours.

Q3: Can I lose money trying to sell an illiquid investment?

Yes, forced sales of illiquid investments often result in 20–40% discounts to estimated fair value, and some illiquid investments may have no buyers at any reasonable price.

Q4: How long should I expect to hold an illiquid investment?

Typical holding periods vary: private equity 5–10 years, venture capital 7–12 years, real estate 3–7 years, though actual timelines depend on exit events outside your control.

Q5: Are illiquid investments only for wealthy investors?

Many illiquid investments require $100,000–$1,000,000 minimums and accredited investor status ($1M+ net worth or $200K+ income), though some real estate and interval funds accept smaller investments.

Q6: What’s the difference between illiquid and volatile?

Illiquidity means difficulty converting to cash quickly; volatility means price fluctuations—stocks can be liquid but volatile, while private equity can be illiquid but appear stable.

Q7: Should I avoid illiquid investments entirely?

No, illiquid investments can provide higher returns, diversification benefits, and tax advantages—the key is maintaining appropriate portfolio balance with sufficient liquid reserves for your needs.

Q8: How do I know if I can afford to invest in illiquid assets?

Ensure you have 6–12 months emergency fund, no high-interest debt, and sufficient additional liquid investments for goals within 5–7 years before committing to illiquid investments.

Q9: What happens if I need to sell an illiquid investment early?

Options include secondary markets (selling at 20–40% discounts), portfolio loans (borrowing against the asset), or waiting for scheduled distributions—all potentially costly or impossible.

Q10: Are there any liquid alternatives to private equity or real estate?

Yes, consider publicly-traded REITs for real estate exposure, Business Development Companies (BDCs) for private credit exposure, or interval funds offering quarterly liquidity for alternative strategies.

Conclusion: Making Smart Decisions About Investment Liquidity

Private equity, real estate properties, and venture capital investments represent the least liquid options available, often requiring 5-10 years before you can convert to cash.

Understanding this liquidity spectrum and honestly assessing your financial flexibility needs prevents the costly mistakes of over-allocating to illiquid investments or panic-selling at steep discounts.

The balanced approach—maintaining 70-90% liquid assets depending on your life stage while selectively allocating 10-30% to illiquid investments—captures higher return potential without sacrificing financial security.

Work with experienced financial advisors, thoroughly understand terms before committing, and regularly review whether your asset allocation still matches your evolving life circumstances for optimal investment success in 2026.