The business landscape of 2026 has fundamentally transformed how companies approach asset valuation and financial reporting.

With AI-driven accounting, ESG integration, and real-time reporting demands reshaping corporate finance, net book value (NBV) has evolved from a simple balance sheet calculation to a strategic financial metric that demands precision and innovation.

Net book value—the carrying value of an asset after subtracting accumulated depreciation from its historical cost—now serves as a critical indicator for investors, regulators, and operational leaders alike. This comprehensive guide explores how leading companies are recalculating, reimagining, and revolutionizing their NBV strategies in 2026, covering everything from AI automation to sustainable asset considerations.

Table of Contents

What Is Net Book Value? A 2026 Primer

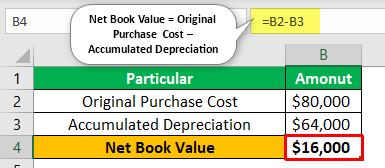

Net book value represents the current worth of an asset on a company’s balance sheet, calculated by subtracting accumulated depreciation from the original purchase cost. In its simplest form, the formula is:

NBV = Original Asset Cost – Accumulated Depreciation.

This carrying value reflects what an asset is “worth” according to accounting standards, not necessarily its fair market value or replacement cost.

Businesses track net book value for multiple critical reasons in 2026.

- First, it ensures GAAP compliance and IFRS alignment for financial reporting.

- Second, it provides insights into capital expenditure effectiveness and asset lifecycle management.

- Third, NBV calculations directly impact tax obligations, insurance valuations, and merger-and-acquisition assessments.

The net book value of fixed assets—from manufacturing equipment to office buildings—appears on the balance sheet as a key component of total assets. For tangible assets like machinery and vehicles, NBV calculation follows established depreciation methods. For intangible assets such as patents and software, the approach considers useful life and potential impairment differently.

In 2026, companies increasingly recognize that accurate NBV tracking goes beyond regulatory compliance. It’s become essential for operational decision-making, helping executives determine when to replace aging equipment, whether to repair or retire assets, and how to optimize asset utilization across the enterprise.

The salvage value—what an asset might be worth at the end of its useful life—also plays a more prominent role in modern NBV calculations, particularly for sustainable assets designed for extended lifecycles.

The Changing Landscape of Asset Valuation in 2026

The economic environment of 2026 has created unprecedented challenges and opportunities for asset valuation practices.

Persistent inflation throughout 2024-2025 forced companies to reconsider how they account for historical cost versus current replacement values. While accounting standards still require NBV calculation based on original purchase cost, the gap between book value and fair market value has widened significantly for many asset classes.

Interest rate fluctuations have also impacted asset depreciation strategies. Higher borrowing costs make capital expenditure decisions more consequential, pushing companies to extend the useful life of existing assets rather than investing in replacements. This shift has led many organizations to reassess their depreciation schedules and salvage value assumptions, particularly for well-maintained equipment that can perform beyond original projections.

Geopolitical considerations now influence NBV calculations in ways previously unconsidered. Supply chain disruptions have made certain equipment types more valuable and harder to replace, affecting both the carrying value perception and the practical decision-making around asset retirement. Companies operating globally must navigate currency fluctuations that impact the book value of international assets.

Perhaps most significantly, technology asset depreciation has accelerated dramatically. The rapid pace of digital transformation means software, servers, and computing infrastructure may become functionally obsolete long before reaching the end of their accounting useful life. This has created a growing disconnect between NBV and actual operational value for technology assets.

Companies in 2026 are responding by implementing more frequent asset impairment reviews, particularly for technology and digital assets.

The traditional annual impairment test no longer suffices in fast-moving industries where six months can render equipment or software platforms outdated. This shift toward continuous asset valuation reflects broader trends in financial automation and real-time reporting that define modern accounting practices.

Trend #1: AI and Automation Transforming NBV Calculations

Artificial intelligence has revolutionized how companies calculate and track net book value in 2026. What once required manual spreadsheet updates and quarterly reconciliation now happens automatically through AI-driven accounting platforms that integrate directly with enterprise resource planning systems.

Leading corporations are deploying machine learning algorithms that analyze historical depreciation patterns, predict asset impairment risks, and recommend optimal depreciation methods for new acquisitions. These systems process vast amounts of data—from equipment maintenance records to market conditions—to provide real-time NBV updates that reflect actual asset performance rather than static assumptions.

One technology company implementing automated NBV systems reported accuracy improvements of 34% and time savings exceeding 200 hours per quarter. Their AI platform automatically adjusts depreciation schedules based on actual usage patterns, maintenance history, and performance metrics captured from IoT sensors embedded in equipment. This level of granularity was impossible with traditional manual NBV calculation methods.

The automation extends beyond simple depreciation schedules. Modern AI systems can predict when assets will require impairment adjustments, flagging equipment showing performance degradation before traditional indicators would trigger a review. This predictive asset value analysis helps CFOs make proactive decisions about capital expenditure and asset replacement strategies.

According to financial technology experts, “AI has transformed NBV from a backward-looking compliance exercise into a forward-looking strategic tool. Companies can now understand not just what their assets are worth today, but how that value will evolve over the next quarter, year, or five years based on current utilization patterns and market conditions.”

The error reduction benefits are equally compelling. Manual NBV calculations often contained mistakes in accumulated depreciation totals, particularly for companies managing thousands of assets across multiple locations. AI systems eliminate these errors through automated verification, cross-referencing purchase cost records, depreciation method assignments, and salvage value estimates across integrated databases.

Financial automation has also democratized access to NBV insights. Where detailed carrying value reports once required specialized accounting expertise to generate, modern dashboards present real-time NBV trends to department managers, enabling operational leaders to understand the book value implications of their equipment decisions without waiting for quarterly financial reports.

Trend #2: ESG and Sustainability Impacting Asset Depreciation

Environmental, Social, and Governance considerations have fundamentally changed how companies approach asset valuation in 2026. Sustainable assets—particularly renewable energy equipment, energy-efficient machinery, and green building systems—often demonstrate extended useful life compared to traditional alternatives, directly impacting NBV calculations.

Companies are discovering that solar panels, wind turbines, and other green assets frequently outlast their original depreciation schedules. One manufacturing company adjusted its salvage value assumptions for renewable energy equipment from 10% to 25% after observing performance data showing minimal degradation after a decade of operation. This change increased the net book value of their sustainable infrastructure by $12 million and reduced annual depreciation expense.

Carbon footprint considerations now influence asset retirement decisions in unexpected ways. Equipment with higher emissions faces earlier obsolescence as carbon pricing mechanisms make operation increasingly expensive. Conversely, low-emission alternatives maintain higher carrying value because their useful life extends beyond traditional timeframes as regulations tighten.

ESG integration has prompted companies to develop new depreciation methods specifically for sustainable assets. Rather than applying straight-line depreciation uniformly, some organizations now use performance-based approaches that adjust the depreciation schedule based on actual environmental impact and efficiency metrics. This ensures NBV calculation reflects the true remaining value of green investments.

Expert perspectives on ESG integration highlight the strategic implications: “Companies that fail to account for sustainability in their NBV calculations are systematically undervaluing their green assets while overvaluing pollution-generating equipment. This creates distorted financial pictures that misguide capital allocation decisions.”

The trend extends to intangible assets as well. Sustainability certifications, carbon credits, and environmental patents now appear on balance sheets with specific carrying value calculations. These intangible assets require unique approaches to accumulated depreciation and useful life determination, as their value often increases rather than decreases over time as environmental regulations strengthen.

Real estate companies are adjusting building asset valuations to reflect climate resilience features. Properties with flood mitigation, extreme weather protection, and energy efficiency systems maintain higher net book value because their useful life extends beyond standard buildings vulnerable to climate impacts. This recognition of climate-related asset value has become standard practice in 2026 financial reporting.

Trend #3: Digital Assets and Intangible Asset Valuation

The explosion of digital transformation initiatives has created entirely new categories of assets requiring net book value calculation. Software capitalization has become one of the most complex and contentious areas of asset valuation, with companies developing sophisticated approaches to determine which development costs qualify as capital expenditure versus operating expenses.

In 2026, cloud infrastructure presents unique NBV challenges. Unlike traditional server equipment with clear purchase costs and physical depreciation, cloud services operate on subscription models. However, companies making significant multi-year cloud commitments are increasingly capitalizing these arrangements and calculating carrying value based on the remaining contract value and accumulated amortization.

Intellectual property valuations have matured significantly. Patents, trademarks, and proprietary technology now receive rigorous NBV tracking, with depreciation methods tailored to their specific characteristics. Technology companies report that intellectual property often represents 40-60% of their total book value, making accurate intangible asset depreciation critical to financial reporting integrity.

Cryptocurrency and blockchain assets have finally achieved accounting clarity in 2026 after years of regulatory uncertainty. Most jurisdictions now require these digital assets to be valued at historical cost with impairment testing at each reporting period. However, the salvage value for cryptocurrency remains effectively zero in most NBV calculations due to extreme volatility, leading to conservative carrying value approaches.

Tech sector examples illustrate the complexity. One software company capitalizes internal development costs for products with expected useful life exceeding three years, applying straight-line depreciation over projected revenue-generating periods. Their NBV calculation includes detailed tracking of developer time, technology stack investments, and infrastructure costs allocated to specific software products.

Regulatory changes affecting digital NBV continue evolving. New accounting standards issued in late 2025 provided clearer guidance on when software-as-a-service development qualifies for capitalization, requiring companies to reassess thousands of projects and potentially restate prior period financial statements to reflect corrected carrying value calculations.

The challenge of rapid obsolescence looms largest for digital assets. A mobile application capitalized with a five-year useful life might become technically obsolete within 18 months due to platform changes or shifting user preferences. This reality has pushed companies toward more conservative depreciation schedules and lower salvage value assumptions for digital products compared to tangible assets.

Trend #4: Real-Time Financial Reporting Demands

Continuous accounting practices have transformed NBV from a quarterly calculation into a daily management metric. Companies implementing real-time reporting systems now update net book value continuously as transactions occur, providing instant visibility into asset carrying value changes triggered by purchases, disposals, or depreciation accruals.

The shift from monthly versus quarterly NBV assessments reflects broader demands for financial agility. Investors and boards no longer accept outdated information—they expect current data showing how capital expenditure decisions impact the balance sheet immediately. This has driven adoption of sophisticated dashboard and visualization tools that present NBV trends alongside operational metrics.

Integration with ERP systems has become non-negotiable for companies serious about real-time NBV tracking. Leading platforms now feature automated interfaces between procurement systems, asset management databases, and financial ledgers, ensuring that every equipment purchase triggers immediate NBV calculation and balance sheet updates without manual intervention.

The benefits of real-time NBV tracking extend beyond speed. Companies report that continuous visibility into carrying value helps prevent asset impairment surprises that previously emerged only during quarterly close processes. When depreciation accumulates daily and systems flag assets approaching full depreciation or exhibiting signs of impairment, finance teams can investigate and address issues proactively rather than reactively.

One manufacturing corporation implemented real-time NBV dashboards across all production facilities, giving plant managers instant visibility into equipment book value. This transparency changed behavior—managers became more conscientious about maintenance, understanding how equipment condition impacts both operational performance and financial statements. The company reported a 22% reduction in unplanned asset write-offs within the first year.

Financial automation supporting real-time NBV calculation also improves audit efficiency. When depreciation schedules run automatically and systems maintain complete documentation of all carrying value adjustments, year-end audits focus on validating system controls rather than reconstructing months of manual calculations. Several companies report audit time reductions of 30-40% after implementing automated NBV systems.

The technology requirements are substantial but increasingly accessible. Cloud-based accounting platforms now offer real-time NBV functionality at price points feasible for mid-market companies, not just large enterprises. This democratization of financial automation is raising the baseline expectations for NBV calculation sophistication across all company sizes.

Industry-Specific NBV Trends in 2026

Manufacturing Sector

Manufacturing companies face unique net book value challenges as they modernize production facilities while maintaining legacy equipment. Equipment modernization impacts create complex scenarios where new automated systems operate alongside decades-old machinery, each requiring different depreciation methods and useful life assumptions.

Smart factory asset valuations reflect the integration of IoT sensors, robotics, and artificial intelligence into traditional manufacturing equipment. A stamping press that once had straightforward NBV calculation now includes embedded sensors worth thousands of dollars with different depreciation schedules than the base machinery. Companies must track these component values separately while presenting consolidated carrying value for financial reporting.

Automation equipment depreciation follows accelerated schedules in many cases. While a traditional assembly line might depreciate over 20 years, its automated equivalent often faces 7-10 year useful life assumptions due to rapid technological advancement. This compression impacts capital expenditure planning and makes accurate NBV calculation essential for understanding true replacement costs.

Manufacturing companies also confront the challenge of international asset bases. A global manufacturer might own identical equipment in ten countries, each with different tax regulations affecting depreciation methods and salvage value assumptions. Maintaining consistent NBV calculation approaches while respecting local accounting requirements demands sophisticated financial systems and cross-border coordination.

Technology Companies

Technology firms experience the most dramatic tension between net book value and actual asset value. Rapid obsolescence means server equipment, network infrastructure, and development hardware often lose functional value far faster than their depreciation schedules suggest. Some companies now apply declining balance method depreciation to technology assets, front-loading accumulated depreciation to better match economic reality.

Server and hardware depreciation has accelerated to 3-5 year useful life assumptions for most technology companies, down from 5-7 years just a decade ago. The shift to cloud computing has created additional complexity—companies must decide whether to capitalize cloud migration costs and infrastructure investments, and if so, over what time period to depreciate these digital capital expenditures.

Software capitalization approaches vary widely across the technology sector. Some companies capitalize all development costs for products intended for sale or license, applying straight-line depreciation over expected revenue periods. Others expense development costs immediately but capitalize purchased software and cloud platform investments. These different approaches create significant NBV variation between otherwise similar companies.

One software company developed a hybrid model where customer-facing application development gets capitalized with 3-year useful life, while internal tools and infrastructure improvements are expensed. This approach attempts to balance book value accuracy with conservative accounting that avoids overstating asset values for products that might never achieve commercial success.

Real Estate and Construction

Real estate companies have embraced building asset revaluations more aggressively in 2026, particularly for properties with significant appreciation potential. While GAAP typically requires historical cost basis, many firms provide supplemental NBV disclosures showing fair market value alongside traditional carrying value to give investors complete pictures of asset worth.

Climate resilience factors now directly impact depreciation assumptions. Buildings in flood-prone areas face accelerated depreciation schedules reflecting higher long-term risk, while properties with climate adaptation features maintain extended useful life assumptions. This risk-based approach to NBV calculation represents a significant evolution from one-size-fits-all building depreciation methods.

Green building premium considerations affect both tangible and intangible asset valuations. LEED-certified properties often command salvage value assumptions 15-20% higher than conventional buildings due to lower operating costs and stronger tenant demand. Additionally, sustainability certifications themselves get capitalized as intangible assets with their own carrying value calculations.

Construction companies face unique challenges tracking net book value for equipment that moves between job sites. Heavy machinery might work on five projects in a year, requiring allocation of depreciation expense across multiple jobs while maintaining accurate accumulated depreciation totals. Advanced asset management software has become essential for construction firms managing hundreds of pieces of equipment.

Healthcare Industry

Healthcare organizations navigate complex medical equipment NBV trends shaped by rapid technological advancement and strict regulatory requirements. An MRI machine might have a 10-year useful life from an engineering perspective, but regulatory changes or insurance reimbursement shifts could render it functionally obsolete within five years, creating asset impairment scenarios.

Regulatory compliance equipment presents valuation challenges when rules change. A laboratory system purchased to meet specific testing standards might require complete replacement if regulations evolve, potentially triggering immediate NBV write-downs regardless of physical condition. Healthcare CFOs must monitor regulatory landscapes and adjust depreciation assumptions proactively to avoid balance sheet surprises.

Technology integration costs represent growing portions of healthcare asset bases. Electronic health record systems, telehealth infrastructure, and AI diagnostic tools now appear on hospital balance sheets as capitalized intangible assets with specific carrying value calculations. The useful life determinations for these digital health assets remain contentious, with estimates ranging from three to ten years depending on system architecture and integration depth.

One hospital network reported that technology assets now represent 35% of their total book value, up from just 18% five years ago. This shift has required completely new approaches to NBV calculation, depreciation method selection, and asset impairment testing tailored to healthcare’s unique operational and regulatory environment.

What CFOs Are Saying: Expert Insights for 2026

Financial executives across industries emphasize that net book value accuracy has become a competitive advantage, not just a compliance requirement. “Our investors demand transparency into asset values and depreciation assumptions,” explains one Fortune 500 CFO. “Companies that can provide detailed NBV analytics with real-time updates command higher valuations because they demonstrate superior financial discipline.”

Technology adoption priorities focus heavily on financial automation platforms that integrate NBV calculation across all asset categories. “We needed systems that could handle tangible assets, intangible assets, and digital investments within a single framework,” notes a technology sector CFO. “The fragmentation of NBV data across multiple platforms created reconciliation nightmares and eroded confidence in our balance sheet accuracy.”

Key concerns about NBV accuracy center on the growing gap between carrying value and fair market value for certain asset classes. Several executives worry that strictly following historical cost principles creates misleading financial statements, particularly for real estate and intellectual property that may appreciate rather than depreciate. “We’re considering supplemental disclosures that show market value alongside book value to give stakeholders a complete picture,” one CFO suggests.

Future outlook perspectives remain cautiously optimistic about emerging technologies improving NBV management. “AI and machine learning will continue transforming how we calculate and monitor asset values,” predicts an industrial manufacturing CFO. “Within three years, I expect fully autonomous NBV systems that require minimal human intervention beyond validating assumptions and approving impairment adjustments.”

The importance of cross-functional collaboration emerges as a consistent theme. “NBV accuracy depends on operational leaders providing realistic useful life estimates, procurement teams capturing complete purchase cost data, and maintenance departments tracking asset conditions,” emphasizes a healthcare CFO. “Finance can’t do this alone—we need organization-wide commitment to asset data quality.”

Common NBV Calculation Methods Companies Use in 2026

Straight-line depreciation remains the most common approach, used by approximately 75% of companies for tangible assets. This method spreads accumulated depreciation evenly across an asset’s useful life, making NBV calculation straightforward and predictable. The formula divides the depreciable amount (purchase cost minus salvage value) by useful life in years, resulting in consistent annual depreciation expense.

Declining balance method appeals to companies with assets that lose value rapidly in early years. This accelerated depreciation approach applies a fixed percentage to the carrying value each year, creating higher depreciation in early periods and lower amounts as the asset ages. Technology companies particularly favor this method for computing equipment and software where obsolescence risk concentrates in the first few years.

Units of production depreciation ties NBV calculation directly to actual asset usage rather than time passage. Manufacturing companies often apply this method to production machinery, calculating depreciation based on machine hours, units produced, or other activity measures. This approach ensures carrying value reflects remaining productive capacity rather than arbitrary time periods.

When to use each method depends on asset characteristics and business objectives. Straight-line depreciation works best for assets with steady, predictable value decline—buildings, furniture, and long-life equipment. Declining balance suits technology and vehicles that depreciate fastest initially. Units of production fits assets where wear-and-tear drives value loss more than age.

Industry preferences have emerged clearly in 2026. Manufacturing favors units of production for core equipment while using straight-line for buildings and infrastructure. Technology companies predominantly use declining balance for hardware and straight-line for software. Real estate almost exclusively applies straight-line to building assets while using component depreciation for major building systems like HVAC and roofing.

Companies increasingly customize depreciation methods to specific asset subcategories rather than applying blanket policies. A single manufacturing plant might use all three methods simultaneously—straight-line for the building, units of production for assembly equipment, and declining balance for quality control technology. This granular approach improves NBV calculation accuracy and better matches depreciation expense to actual value consumption.

How to Calculate Net Book Value: Step-by-Step Guide

Step 1: Determine original asset cost. Begin with the complete purchase cost including the base price, delivery charges, installation fees, and any modifications necessary to make the asset operational. For example, a CNC machine with $500,000 purchase price, $15,000 delivery, and $35,000 installation has total historical cost of $550,000.

Step 2: Identify depreciation method. Select the appropriate approach based on asset type and usage patterns. For our CNC machine example, assume the company chooses straight-line depreciation as the most appropriate method given consistent production usage expected throughout the asset’s life.

Step 3: Calculate accumulated depreciation. Determine useful life (assume 10 years) and salvage value (assume $50,000). Depreciable amount equals $550,000 – $50,000 = $500,000. Annual depreciation equals $500,000 ÷ 10 = $50,000. After three years, accumulated depreciation totals $150,000.

Step 4: Apply the formula. Net Book Value = Original Asset Cost – Accumulated Depreciation. For our example: NBV = $550,000 – $150,000 = $400,000. This carrying value represents what the machine is worth on the balance sheet after three years of operation.

This practical example with 2026 numbers demonstrates the fundamental NBV calculation process. The same methodology applies whether tracking a single asset or managing thousands across multiple locations. Modern financial automation systems perform these calculations continuously, updating carrying value daily as depreciation accrues and immediately when assets are purchased, sold, or impaired.

NBV vs Market Value: Understanding the Difference in 2026

Key distinctions between net book value and fair market value create important implications for financial analysis. NBV represents accounting value based on historical cost and predetermined depreciation schedules, while market value reflects what an asset would sell for in current conditions. These figures often diverge significantly, particularly for real estate, intellectual property, and unique equipment.

When each matters depends on the decision context. NBV is essential for financial reporting, tax calculations, and GAAP compliance. Market value matters for sale transactions, insurance coverage, and strategic decisions about asset retention versus disposal. Neither metric is inherently “better”—they serve different purposes in comprehensive asset management.

Impact on company valuation can be substantial. A company with significant real estate holdings might show modest book value while sitting on properties worth millions more at current market prices. Conversely, a technology company might carry software at substantial NBV that has little market value if tied to proprietary systems. Sophisticated investors analyze both metrics to understand true asset positions.

Investor perspective increasingly demands transparency about NBV versus market value gaps. Many companies now provide supplemental disclosures explaining significant differences, particularly for asset classes like real estate where appreciation can create massive disparities. This transparency helps investors make informed decisions without being misled by balance sheet carrying values that don’t reflect economic reality.

The accounting principle of conservatism traditionally favored lower valuations, making NBV based on historical cost appropriate for most tangible assets that depreciate. However, this approach struggles with appreciating assets and intangible assets whose value grows over time. The tension between conservative accounting and economic reality continues driving discussions about asset valuation reform.

Challenges Companies Face with NBV in 2026

Asset impairment considerations create ongoing headaches for financial teams monitoring carrying value. Determining when assets have suffered impairment—meaning their recoverable amount falls below NBV—requires judgment about future cash flows, market conditions, and technological obsolescence. Conservative companies test for impairment quarterly; others wait for triggering events, risking sudden balance sheet adjustments.

Rapid technological change particularly affects intangible assets and digital infrastructure. Software platforms capitalized with five-year useful life might become obsolete within two years as new technologies emerge. Companies must balance conservative depreciation assumptions against the risk of carrying obsolete assets at inflated NBV, potentially misleading investors about actual asset quality.

Inflation adjustments present thorny challenges in 2026’s economic environment. While accounting standards require historical cost basis for NBV calculation, persistent inflation means replacement costs far exceed original purchase prices for many assets. This creates situations where fully depreciated equipment shows zero book value despite requiring hundreds of thousands to replace.

Regulatory compliance complexity grows as accounting standards evolve. New guidance on lease accounting, software capitalization, and digital asset treatment requires companies to reassess NBV calculations for thousands of items. The cost of compliance—including system updates, staff training, and audit fees—has increased substantially, particularly for multinational corporations navigating different standards across jurisdictions.

Data accuracy and integration issues plague companies with legacy systems and decentralized asset management. Calculating accurate NBV requires reliable data on purchase costs, acquisition dates, depreciation methods, useful life assumptions, and salvage values. When this information exists across spreadsheets, paper records, and incompatible databases, achieving NBV accuracy becomes nearly impossible without significant data cleanup and system investment.

Best Practices for NBV Management in 2026

Regular asset audits have become quarterly rather than annual exercises for companies committed to NBV accuracy. Physical verification of asset existence, condition assessment, and reconciliation with financial records help identify discrepancies before they snowball into material misstatements. Leading companies deploy mobile asset tracking technology enabling continuous verification rather than point-in-time audits.

Technology integration recommendations emphasize end-to-end platforms connecting procurement, asset management, maintenance, and financial systems. This integration ensures that every asset transaction—from purchase order through disposal—automatically updates NBV calculations without manual intervention.

Cloud-based solutions have made enterprise-grade asset management accessible to mid-market companies previously limited to spreadsheet-based approaches.

Documentation standards must address not just current NBV but the assumptions and judgments underlying carrying value. Companies should maintain detailed records explaining depreciation method selection, useful life determinations, salvage value estimates, and impairment testing results. This documentation proves essential during audits and when management changes require knowledge transfer about asset valuation approaches.

Cross-department collaboration between finance, operations, procurement, and maintenance teams improves NBV accuracy and decision-making. Finance needs operational input on realistic useful life and salvage value estimates. Operations needs financial data on carrying value to make informed equipment replacement decisions. Regular cross-functional reviews of asset portfolios help align accounting assumptions with operational reality.

Professional software solutions designed specifically for asset management and NBV calculation have matured significantly by 2026. Leading platforms offer depreciation automation, impairment testing, component tracking, predictive analytics, and real-time dashboards. While implementation requires investment, companies report ROI within 12-18 months through improved accuracy, reduced audit costs, and better capital expenditure decisions enabled by reliable carrying value data.

Additional best practices include establishing clear approval workflows for depreciation assumption changes, implementing automated alerts for assets approaching full depreciation, creating standardized templates for impairment testing, and developing regular reporting packages showing NBV trends across asset categories and business units.

The Future of Net Book Value: 2027 and Beyond

Emerging trends suggest net book value will become increasingly dynamic and real-time oriented. The concept of “closing the books” quarterly or monthly will fade as continuous accounting enables instant NBV updates. Companies will track carrying value with the same real-time precision currently reserved for cash balances and accounts receivable.

Technology predictions center on artificial intelligence taking over routine NBV calculation entirely. By 2027, AI systems will likely select optimal depreciation methods for new assets, adjust useful life assumptions based on actual performance data, and flag potential impairments automatically. Human judgment will shift from performing calculations to validating AI recommendations and making final decisions on material items.

Blockchain and distributed ledger technology may revolutionize asset tracking and NBV verification. Immutable records of asset purchases, transfers, and disposals could eliminate reconciliation challenges while providing auditors with complete transaction histories. Some experts predict industry consortiums developing shared asset registries that standardize historical cost and accumulated depreciation tracking across companies.

Regulatory changes on horizon include potential reforms allowing more frequent asset revaluations to fair market value, particularly for long-lived assets like real estate and infrastructure. While full fair value accounting remains controversial, hybrid approaches combining historical cost with periodic revaluation might emerge, creating new NBV calculation complexity.

Environmental considerations will increasingly influence carrying value through carbon accounting integration. Assets with high emissions may face accelerated depreciation or impairment charges as carbon pricing expands globally. Conversely, carbon-negative assets might receive extended useful life recognition or premium salvage value assumptions.

Preparation recommendations emphasize building flexible financial systems capable of adapting to evolving NBV requirements. Companies should invest in platforms supporting multiple depreciation methods, component-level tracking, and configurable reporting to accommodate future regulatory changes. Developing strong governance around asset data quality positions organizations to leverage emerging NBV technologies rather than being overwhelmed by them.

Conclusion

Net book value management has transformed from routine accounting to strategic imperative in 2026, driven by AI automation, ESG integration, and real-time reporting demands.

Companies embracing these trends—through technology adoption, cross-functional collaboration, and rigorous asset data quality—gain competitive advantages through superior capital allocation, accurate financial reporting, and investor confidence.

Now is the time to evaluate your current NBV processes against 2026 best practices.

Frequently Asked Questions

What is net book value in simple terms?

Net book value (NBV) is an asset’s original purchase cost minus accumulated depreciation. It represents the asset’s current accounting worth on the balance sheet.

How often should companies calculate NBV in 2026?

Leading companies now calculate NBV continuously using automated systems, while quarterly verification is still standard for audit and reporting purposes.

Can NBV be negative?

No, NBV cannot be negative because accumulated depreciation cannot exceed the original asset cost under standard accounting practices.

How does AI improve NBV calculations?

AI automates depreciation schedules, predicts impairment risks, and adjusts carrying values based on real-time asset performance data.

What’s the difference between NBV and fair market value?

NBV is based on historical cost minus depreciation, while fair market value reflects the current selling price in active markets.

How do ESG factors affect NBV?

Sustainable assets often receive longer useful life and higher salvage value assumptions, which can increase their net book value compared to conventional alternatives.

What software do companies use for NBV tracking?

Enterprise platforms like SAP and Oracle, along with specialized tools like Asset Panda, provide integrated NBV tracking with ERP system connectivity.